|

11.08.2025 09:07:51

|

AMINA Bank: The Rise of Crypto Treasury Companies

We previously took a deep dive into Michael Saylor’s Strategy’s Bitcoin playbook. In this edition of the Crypto Market Monitor, we go broader. We unpack how this trend has spread beyond Bitcoin to assets like Ethereum, Ripple and Sui, why the narrative is booming and the growing risks beneath the surface.

The Origin of Bitcoin Treasury Companies

Bitcoin’s journey into corporate treasuries began in 2020 with Michael Saylor’s Strategy. In August 2020, Strategy made a bold move by purchasing 21,454 BTC (worth around $250 million at the time) as a primary reserve asset. This unprecedented bet turned the company into the first Bitcoin treasury company, an entity whose business model revolves around holding Bitcoin on its balance sheet. The impact was dramatic. Over the next five years Strategy’s stock price skyrocketed over 3,300%, vastly outperforming the S&P 500 and even Bitcoin itself. By treating BTC as digital gold, Strategy’s experiment demonstrated a new corporate finance strategy to the world.

The floodgates truly opened in 2024. As Bitcoin’s price rebounded and regulatory sentiment improved, many other companies followed suit. What began with one company’s bold bet in 2020 exploded into a global trend by 2024, with firms across sectors issuing stock or debt to accumulate crypto. As of writing this article,163 public companies hold Bitcoin on their balance sheets, alongside dozens of private firms and even pension funds. Collectively, public corporations hold around 961.7K BTC (worth over $110 billion).

Figure 1: Cumulative Bitcoin Holdings by Top Public Companies

Source: The Block, Bitcoin Treasuries (7 August 2025)

The Rise of ETH treasury companies

After Bitcoin, Ethereum has emerged as the next favourite for corporate treasuries. In the past year, a wave of companies began accumulating ETH as a strategic asset. By late 2024 and into 2025, several companies announced major Ether purchase programs, marking what some called Ethereum’s MicroStrategy moment. Currently, total ETH held by public companies has exceeded 1.74 million (worth over $6.5 billion).

Why Ethereum? Unlike Bitcoin, ETH is a yield-bearing asset. In addition to a growth in market value, holding ETH allows companies to earn staking rewards and to deploy capital in DeFi protocols. This gives Ethereum treasuries a productive asset that also generates cashflow, not just a passive store of value. For example, NASDAQ-listed SharpLink pivoted from sports betting to become a pure Ethereum holding company in 2025. Through multiple equity raises, including a significant $425 million private investment and subsequent equity offerings, the company rapidly built the second largest Ethereum position among its peers. With Ethereum co-founder Joseph Lubin as its new chairman, SharpLink currently holds close to $2 billion in ETH. SharpLink stakes 100% of its ETH, earning additional yield.

Another example is BitMine Immersion Technologies, a corporate Bitcoin adoption advisory company, that completely shifted to an Ethereum treasury strategy in 2025. Backed by investors like Peter Thiel’s Founders Fund and with the board chaired by Wall Street strategist Thomas Lee, BitMine raised $250 million in June 2025 to acquire ETH. Today, it holds 833K ETH, making it the largest Ether-holding company with over $3 billion in ETH reserves. BitMine’s pivot was so well-received that the stock jumped 400% on the news of the raise. BitMine signalled plans to integrate staking yields soon.

Mining firm Bit Digital has also raised roughly $170 million through a public equity raise and sold some of its bitcoin holdings (currently worth $30 million) to accumulate ETH. However, the firm has not confirmed whether any portion has been staked or deployed onchain currently.

A new company called The Ether Machine is aiming to harness ETH’s potential by actively managing and growing its utility. In addition to a passive investment into ETH, it is focusing on ETH-denominated income generation through staking yield while also building infrastructure solutions like validator tools. Additionally, it supports innovation on the Ethereum network through partnerships and research. The company is set to go public via a special purpose acquisition company (SPAC) merger with Nasdaq-listed Dynamix Corporation (an investment firm focused on the energy and infrastrucure sectors). It intends to launch with a treasury of 400K ETH. The deal is expected to close in Q4 2025 and is backed by over $800 million from major investors including crypto exchange Kraken, investment firm Pantera Capital. The Ether Machine aims to become the largest publicly traded Ethereum treasury offering for institutional investors.

Figure 2: Cumulative ETH Holdings by Top Public Companies

Source: The Block, Yahoo Finance (25 July 2025)

In summary, what is being witnessed is the rise of ETH-focused treasury companies that treat Ether as a core balance sheet asset and as a yield-bearing investment. As a group, these ETH treasuries have amassed over 1.41% of total ETH supply.

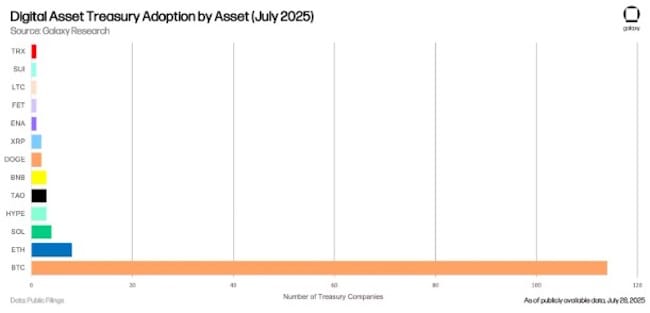

Beyond BTC and ETH

The crypto treasury phenomenon hasn’t stopped at Bitcoin and Ethereum. A few companies have now started eyeing other altcoins as reserve assets.

Figure 3: Public Companies’ Digital Asset Treasury Adoption by Asset

Source: Galaxy Research (28 July 2025)

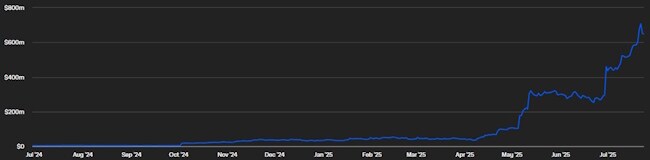

SOL, for instance, has drawn interest due to its high performance blockchain and roughly 6-8% staking yield currently. At the time of writing, cumulative SOL holdings by public companies stands at 3.44 million SOL (worth $651million at current prices). Firms like DeFi Development and Upexi (both built solely to be Solana-focused treasury companies) are accumulating SOL for its combination of growth in market valuation and its ability to generate staking income.

Figure 4: Cumulative SOL Held by Public Companies

Source: The Block (24 July 2025)

Another notable altcoin treasury trend is in XRP, the native token of the Ripple payment network. After Ripple’s partial court victory in the U.S. provided regulatory clarity that XRP was not a security in certain contexts, interest in XRP spiked. Over the past year, the token has rallied by over 480%, capturing both retail and institutional interest. And now, some public companies are slowly accumulating the asset as part of the treasury strategy. For example, Nature’s Miracle Holdings, a U.S. agricultural tech firm, announced a plan to allocate up to $20 million into XRP. They even intend to stake the XRP holdings for yield and integrate with RippleNet for payments. Around the same time, VivoPower International, a Nasdaq-listed energy firm, raised $121 million to build an XRP reserve, aiming to become the world’s first XRP-focused enterprise. At the time of writing, public companies have announced plans of buying more than $980 million worth of XRP for their treasuries.

Another headline-grabbing development is the rise of SUI (the native token of the Sui Layer-1 blockchain) as a corporate treasury asset. In July 2025, Mill City Ventures, a Nasdaq-listed lender, announced it had raised $450 million and immediately spent roughly $276 million of it to buy 76.2 million SUI tokens. Mill City then secured an additional $500 million equity line to continue investing in SUI, in partnership with the Sui Foundation and Galaxy as asset manager. This made Mill City effectively the first SUI treasury company, with an official relationship to the token’s foundation. The news sent Mill City’s share price soaring 165% in late July 2025.

What started as a Bitcoin-only trend has evolved into a broad multi-asset crypto treasury movement. Public companies worldwide are now targeting a whole spectrum of tokens. This diversity indicates that companies are selecting crypto assets aligned with their strategic goals or sector (e.g. payment firms choosing XRP, tech firms choosing high-throughput chains).

The Risks

Despite the enthusiasm, the crypto treasury trend carries significant risks. These risks operate on two levels: company-specific risks (facing the individual firms and their shareholders) and systemic risks (broader effects on markets and the crypto ecosystem).

Company-specific risks

Volatility

The most immediate risk is the financial volatility introduced by holding large crypto positions. Cryptocurrency prices are notoriously volatile. A 20% drawdown in a month is not uncommon. For a crypto treasury company, such swings directly erode the value of its reserves and can wreak havoc on its stock price and financial stability. A sharp movement in Bitcoin or altcoins could leave a crypto treasury company with impaired assets or large accounting losses (under U.S. GAAP, crypto is often recorded as an intangible asset subject to impairment write-downs if prices fall). If a crypto treasury company has also taken on debt to buy crypto, the scenario worsens where they may face margin calls or debt covenant breaches if the collateral value plunges.

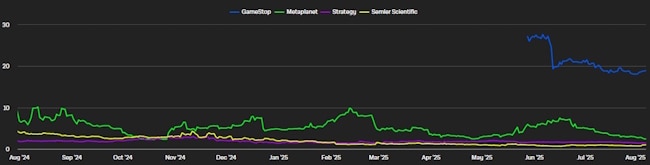

Drop in Premium

Additionally, some of these crypto treasury companies are engaging in convertible debt issuances to raise funds. Some of them have little revenue outside of paper gains on their tokens. For instance, Strategy announced a $9.5 billion gain on its Bitcoin holdings for Q2 2025. However, the firm saw negative operating cashflows (-$34.9 million) during the time. Sharplink too has seen negative operating cashflow and negative net income in its past few quarters. This means no underlying cash flow to support the business if crypto winter arrives. If market sentiment cools, they could struggle to raise fresh capital while still needing to serve their dividend obligations. In extreme cases, treasury-heavy firms could be forced to liquidate holdings to service debt. This could see their stock tumble to penny-stock territory in some cases.

Tracking how much the market price of crypto treasury stocks exceeds the value of their underlying crypto holdings is also important. A high premium (recently averaging 63% for Ethereum-focused firms) reflects optimistic growth expectations but also indicates speculative froth. As long as new investors buy the stock at a premium, the company can raise money (harvesting those investor funds) to buy more crypto, boasting outsized yields not from operations but from continuous fundraising. Should the equity premium vanish (i.e. the stock starts trading closer to NAV), new raises would become highly dilutive, potentially bankrupting over-leveraged crypto treasury companies.

Figure 5: Top Bitcoin Treasury Companies Premium/Discount to NAV

Source: The Block, Bitcoin Treasuries (7 August 2025)

Altcoin Risk

Another specific risk lies in the choice of asset beyond Bitcoin. If an altcoin’s value collapses due to a hack or protocol failure, the treasury invested in it could be nearly wiped out. Altcoins also face the risk of shifting regulatory winds (a single adverse court ruling or enforcement action could quickly depress market value). Thus, concentrating corporate funds in one niche crypto asset introduces significant concentration risk. Unlike a diversified crypto fund, many of these companies are betting the farm on one or two tokens.

Systemic and market risks

At a broader level, if the crypto treasury trend grows, it could increase the interconnectedness between crypto markets and traditional equity markets. If dozens of companies across sectors hold significant crypto, a crypto market crash could propagate losses to equity markets (through those companies’ valuations). The correlation between tech stocks and crypto might strengthen, potentially introducing more volatility into stock indices and even passive portfolios that include these firms.

One looming systemic concern is a scenario where the cycle turns vicious. Currently, crypto treasury companies collectively hold a relatively small slice of the total crypto market. (4.8% for Bitcoin treasury companies and 1.45% for Ethereum treasury companies) Their buying has provided extra demand and a positive feedback loop for crypto prices. But if this category grows and these companies hold a significant amount of all BTC or ETH at some point these companies are forced to unwind due to a market downturn or inability to raise more capital, they could end up flooding the market with sell orders triggering a crypto crash. In other words, the very act of many companies buying crypto can inflate prices and valuations on the way up, but if confidence is lost, the collective selling could conversely accelerate a collapse.

Regulatory risk also hovers as a factor. Thus far, regulators have not heavily intervened in how corporations manage crypto on their balance sheets (beyond accounting rules). But if a high-profile treasury implosion occurs or if the practice becomes deemed a threat to financial stability, regulators could impose new restrictions. Any moves to limit corporate crypto holdings could quickly dampen this trend.

Conclusion

A possible outcome of a broader unwind in the crypto treasury space is consolidation across the sector with larger cash-heavy firms acquiring smaller distressed players during extreme market downturns. Companies with healthy NAV multiples could acquire holdings of smaller crypto treasury companies (which may be forced to distress sell their holdings during major market downturns) below their market value. Larger, well-funded firms like Strategy which still trade at a premium might try to capitalise on this opportunity. But this only works if the buying company keeps its premium. Such consolidation waves may reshape the sector, increasing the dominance of larger firms with good risk management while offering a lifeline for smaller ones amid market volatility.

By keeping an eye on the key factors like valuations, capital flows, and the broader market environment, investors can get a clearer picture of how sustainable this trend really is. It is an exciting shift, blending corporate finance with digital assets. But it also brings new risks to both worlds.

The coming years will show whether this strategy can survive changing market conditions. Will these crypto treasury companies hold on through volatility and prove the value of their approach, or will we see many of them exit the market? In crypto, it is rarely a smooth ride, and this might be no different.

BITCOIN KAUFEN? DAS SOLLTEN SIE JETZT WISSEN!

Was beim Einstieg wirklich zählt: Sichere Handelsplätze finden, wichtige Grundlagen und aktuelle Trends verstehen.

Jetzt informieren und fundiert in Bitcoin investierenTop Kryptowährungen

| Bitcoin | 90’892.09827 | -0.15% | Handeln |

| Vision | 0.13255 | 4.98% | Handeln |

| Ethereum | 3’513.49452 | 1.12% | Handeln |

| Ripple | 2.40792 | 1.08% | Handeln |

| Solana | 179.90788 | 0.54% | Handeln |

| Cardano | 0.70048 | -0.88% | Handeln |

| Polkadot | 3.33094 | -1.02% | Handeln |

| Chainlink | 18.92604 | 0.56% | Handeln |

| Pepe | 0.00001 | -0.97% | Handeln |

| Bonk | 0.00002 | 2.45% | Handeln |

Inside Krypto

Ob Industrie 4.0, Luxusgüter oder Internet-Infrastruktur - hier finden Sie aktuelle Anlagetrends mit vielen Hintergrundinformationen und passenden Trendaktien. Jetzt mehr lesen

„Silber schlägt Gold?“ – Der geheime Favorit 2025! mit Prof. Dr. Torsten Dennin

💥 Silber 2025: Das unterschätzte Investment?

Im heutigen BX Swiss TV Experteninterview spricht Prof. Dr. Torsten Dennin (CIO der Asset Management Switzerland AG) darüber, warum Silber aktuell das vielleicht spannendste Rohstoff-Investment überhaupt ist.

Gemeinsam mit Olivia Hähnel (BX Swiss) beantwortet er folgende Fragen:

👉 Ist Silber der neue Geheimfavorit gegenüber Gold?

👉 Welche Rolle spielt der Boom bei Solar und Hightech für die Preisentwicklung?

👉 Und wie kann man als Anleger konkret profitieren – mit welchen Chancen und Risiken?

🔍 Das erwartet euch im Interview:

◽ Aktuelle Marktsituation und Hintergründe zum Silberpreis

◽ Gold vs. Silber: Unterschiede & Investmentpotenzial

◽ Industrielle Treiber: Solar, Energiewende, Zukunftstechnologien

◽ Angebot, Nachfrage & Lagerbestände: Warum der Markt im Defizit ist

◽ Investieren in Silber: physisch, ETFs, Zertifikate, Minenaktien

◽ Chancen & Risiken von Explorationsunternehmen vs. Produzenten

◽ Strategien für sicherheitsorientierte Anleger

◽ Prognose: 45–50 USD – oder mehr?

👉🏽 Jetzt auch auf BXplus anmelden und von exklusiven Inhalten rund um Investment & Trading profitieren!