|

Gurit Holding AG / Key word(s): Half Year Results

GURIT ANNOUNCES NET SALES OF CHF 164.7 MILLION. THANKS TO SUCCESSFUL COMPLETION OF RESTRUCTURING EFFORTS, THE ADJUSTED OPERATING PROFIT MARGIN INCREASES TO 5.7% FOR THE FIRST HALF-YEAR OF 2025.

20-Aug-2025 / 06:45 CET/CEST

Release of an ad hoc announcement pursuant to Art. 53 LR

The issuer is solely responsible for the content of this announcement.

Zurich, August 20, 2025 – Ad hoc announcement pursuant to Art. 53 LR

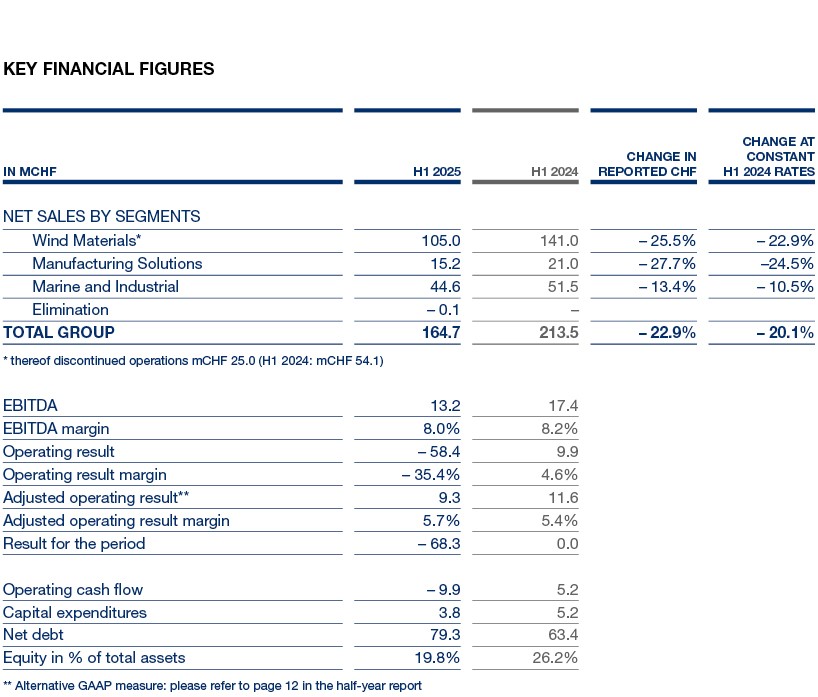

Gurit (SIX Swiss Exchange: GURN) today reports unaudited net sales for the first half of 2025 at CHF 164.7 million, marking a decrease of -20.1% at constant exchange rates or -22.9% in reported CHF compared to the same period in 2024. Gurit reached an adjusted operating profit of CHF 9.3 million with an adjusted operating profit margin of 5.7%. This compares to CHF 11.6 million or 5.4% in the first half of the prior year. The performance of Wind Materials was mainly improved by the planned exit of the carbon fiber pultrusion business, whereas Marine and Industrial was impacted by an overall wait and see attitude of customers caused by the US tariff discussions. Following the completion of its restructuring and ongoing new markets development efforts, Gurit remains confident about the success of its currently undergoing strategic realignment and achieving a full-year adjusted operating profit margin similar to the 2024 levels.

Gurit successfully completed its restructuring efforts in the first half of 2025, resulting in a leaner and more focused organization. This strategic realignment, initiated in 2024 in response to Wind market volatility, has led to operational improvements, cost reductions, and a more resilient structure. The transformation plan supports Gurit’s multi-market strategy and positions the company for continued progress.

Wind Materials achieved net sales of CHF 105.0 million for the first half of 2025. This represents a decrease of -22.9% at constant exchange rates compared to the first half of 2024. Sales in the Wind segment were lower, primarily due to the planned exit from the carbon fiber pultrusion business. Importantly, the segment’s competitiveness and profitability showed substantial improvements, supported by the closure of non-strategic production locations and cost-saving initiatives, as well as focusing on profitable core materials business. Gurit also continues to prioritize the strengthening of relationships with key Westerns Wind customers and is actively finalizing long-term agreements - an important step toward securing stable and sustained growth.

Manufacturing Solutions reported net sales of CHF 15.2 million for the first half of 2025. This marks a decrease of -24.5% at constant exchange rates compared to the first half of 2024. Manufacturing Solutions recorded reduced sales due to delays from Western customers awaiting clarity on the tariffs before investing in blade lines. In contrast, the Indian market showed strong momentum and regional growth opportunities. A better second half is expected as several Wind customers are firming up investment decisions.

Marine and Industrial achieved net sales of CHF 44.6 million in the first half of 2025. This represents a decrease of -10.5% at constant exchange rates compared to the first half of 2024. A large project was expected to start in H1 and has been postponed to the 4th quarter, and a wait and see attitude has been noticed in all submarkets where investment projects are included, due to the overall US tariffs-led market uncertainty. Gurit has an unchanged confidence in Marine and Industrial opportunities. The company sees a clear customer value in foams from recycled materials, demonstrated by large contracts recorded in new markets such as office furniture or recreational vehicles. Furthermore, Gurit continues to identify significant opportunities in the marine vessels sector and is making strong progress in this attractive area with its exclusive products like Corecell S-Foam.

Restructuring

The company’s successful restructuring delivered a leaner, more focused organization and a higher adjusted operating profit margin year-on-year. Targeted global footprint optimization and cost rationalization strengthened its resilience and positioned it to capture long-term wind sector opportunities. This translates into a discontinuation of four sites and a reduction of SG&A costs related to its right-sizing efforts.

The total restructuring expenses amounted to CHF 40 million; the majority of the cash flow impact was booked in the first half of 2025. Impairment expenses thereof stood at CHF 18 million.

Strategic Realignment

The company is pivoting towards a multi-market strategy, driving greater diversification across its business segments and building on its strong presence in the Marine and Industrial markets. Gurit is steadily advancing its lightweight initiatives, with deliveries of recycled PET to new industrial customers and pursuing emerging opportunities in the marine vessels sector. The planned strategic realignment reinforces Gurit’s global position as a leader in performance materials.

Supply Chain

During the first half of 2025, Gurit experienced some relief in supply chain costs driven by operational improvements. Logistics expenses, while still higher compared to 2024 levels, have decreased from their late-2024 peaks despite Red Sea disruptions that continue to contribute with higher complexity routes and increased lead times.

US Tariffs

The US tariffs situation is not stable yet so assessing its full impact is challenging. In the first half of 2025 the direct impact, i.e. higher tariffs on goods and services exported to the US by Gurit, has been limited to a low single digit negative sales effect, and a small profit impact, mitigated by price increases and adjustments in sourcing strategies.

By far the largest influence of this unstable tariff’s situation has been the indirect impact, i.e. customers lowering orders as they needed or plan to relocate some of their production. Gurit has seen capital investment decisions postponed due to the uncertainty. Gurit estimates that this had a high single-digit impact both on the Marine and Industrial sales and on the Wind Manufacturing Solutions sales, with the corresponding profit decrease. The direct impact should continue to be limited in the second half of the year. The indirect impact will improve as customers have completed supply chains adjustments.

Sustainability and Corporate Governance

Gurit’s decarbonization efforts continue with progress in green energy contracts, particularly in China, and the EU Horizon-funded Repoxyble project advancing well. The collaboration with ReUsablade reflects promise in recycling technologies. Gurit also identifies new circularity opportunities and maintains high mechanical performance with ‘bio-based’ formulations. Additionally, the Human Rights Due Diligence Policy was implemented, with employee training and a workshop to review and mitigate risks.

Organization

Tobias Lührig assumed the role of CEO on July 1, 2025. With over 20 years of experience in private family-owned and private-equity backed companies, he brings a strong track record in driving operational efficiency, strategic realignment and margin enhancement, making him well equipped to drive Gurit’s ongoing realignment.

As communicated in May, Javier Perez-Freije, currently serving as CFO, will be leaving the company at the end of November 2025. The search for a new CFO is well advanced and the nomination will be announced in due course.

Profitability

In the first half of 2025, Gurit achieved an adjusted operating profit margin of 5.7%. Given the discontinuation of the carbon fiber pultrusion business, an anticipated cash and equity neutral goodwill recycling of CHF 64.2 million impacted the Group’s income statement as required under Swiss GAAP FER. These restructuring charges incurred during the period, led to an operating profit loss of CHF -58.4 million. In comparison, the first half of 2024 recorded an adjusted operating profit margin of 5.4% and an operating profit margin of 4.6% including restructuring costs. With the completion of the restructuring and strategic actions, Gurit anticipates that the operating profit will further improve in the second half of this year.

Cash Flow and Balance Sheet

Gurit incurred a net cash outflow from operating activities of CHF -9.9 million in the first half of 2025, compared to CHF 5.2 million inflow in the same period of the previous year. The performance was mainly impacted by restructuring costs incurred during the period.

Capital expenditure reached CHF 3.8 million during the first half of 2025, compared to CHF 5.2 million in the first half of the previous year.

Outlook

As we look ahead, Gurit is well-positioned to seize opportunities across its key markets and to continue advancing its multi-market strategy, focusing on the most profitable sectors of the Wind and non-Wind markets. Throughout the first half of 2025, this has remained Gurit’s clear priority — and it will continue to guide its efforts for the remainder of the year. With the right-sizing of the organization now successfully completed, Gurit is well equipped to deliver on its strategic goals. Gurit will maintain its focus on innovation, expand its portfolio of sustainable solutions, and build resilience through strategic diversification. These priorities reflect its commitment to long-term value creation and to supporting the transition to a more sustainable future.

For 2025, Gurit expects to achieve an adjusted operating profit margin similar to the 2024 level and expects net sales to be around CHF 300 million. Importantly, with the completion of the strategic realignment actions, the cost benefits should continue to materialize later in the second half of the year, supporting overall profitability.

Due to proactive repositioning, Gurit remains confident in its long-term outlook for mid-single-digit growth in its Wind business and high-single-digit growth in its non-Wind businesses. The company also reaffirms its mid-term target of achieving a 10% operating profit margin.

Online Publication of Half-Year Results and Media/Analyst Online Conference

On Wednesday, August 20, 2025, the Gurit Management will discuss the results of the first half-year 2025 interim report in a public webcast at 09:00 AM CEST. The presentation will be held in English and is accessible at https://www.gurit.com/investors/reports. An archived version will later be made available on the same link. The half-year report 2025 is available for download under the following link: https://www.gurit.com/investors/reports.

About Gurit

The subsidiaries of Gurit Holding AG, Wattwil/Switzerland, (SIX Swiss Exchange: GURN) are specialized in the development and manufacture of advanced composite materials, composite tooling equipment and core kitting services. The product range comprises structural core materials, structural profiles, prepregs, formulated products such as adhesives and resins as well as structural composite engineering. Gurit supplies global growth markets such as the wind turbine industry, marine, building and many more. Gurit operates production sites and offices in Australia, Canada, China, Denmark, Ecuador, India, Mexico, New Zealand, Poland, Spain, Switzerland, United Kingdom, and the United States.

www.gurit.com

Gurit Group Communications

Phone: +41 44 316 15 50, e-mail: investor (at) gurit.com

All trademarks used or mentioned in this release are protected by law.

Forward-looking statements:

To the extent that this announcement contains forward-looking statements, such statements are based on assumptions, planning and forecasts at the time of publication of this announcement. Forward-looking statements always involve uncertainties. Business and economic risks and developments, the conduct of competitors, political decisions and other factors may cause the actual results to be materially different from the assumptions, planning and forecasts at the time of publication of this announcement. Therefore, Gurit Holding AG does not assume any responsibility relating to forward-looking statements contained in this announcement.

End of Inside Information

|