|

04.05.2022 09:38:06

|

21Shares: US Air Force in the Metaverse, Kraken in Abu Dhabi, and More!

This Week in Crypto

The cryptoassets market has stagnated at $1.89T in market cap, with Bitcoin and Ethereum dropping by over 5% since April 19. Whales have been buying the dip shortly after Bitcoin fell below the $40K mark, as shown in the figure below. On the other hand, high outflows of approximately $97M were made from crypto funds in reaction to the Federal Reserve’s plans to shrink bond holdings by $95B a month, as a hedge against inflation. Fluctuation in price action is speculated to persist in the coming few months, as the Fed expects to raise interest rates by 50 BPS in May. Another macro factor that might be driving the red candle wicks on the chart below is the fall of Chinese stocks, commodities and yuan after the country’s strict Covid Zero policy intensified on Monday.

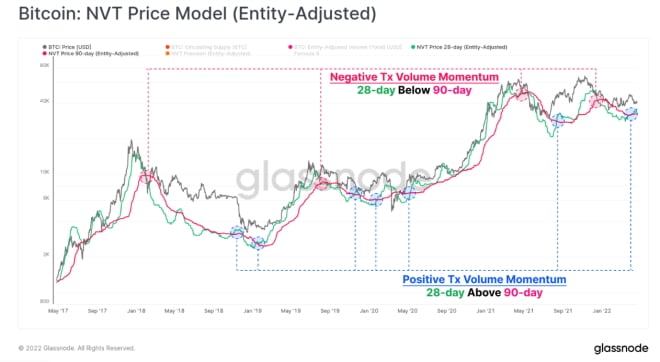

One interesting metric worth looking into is Bitcoin’s Network-Value-Transaction (NVT) pricing model. The framework takes the two-year median of the NVT ratio - determined by dividing the network’s total value by its daily transaction volume - then multiplying it by the current transaction volume. Looking at the 28 and 90-day periods, it can be argued that both models are starting to show signs of bottoming. This has historically preceded phases where Bitcoin began initiating a rally, as indicated through the several blue circles on the chart below, during January 2019, May 2020, and September 2021. It will still take some time to confirm the continuing crossover of the 28-day above the 90-day period, so it is a development we’ll be watching closely.

Regulations

The US Treasury Department imposed sanctions on BitRiver, the Russian Bitcoin mining hosting firm whose parent company is based in Switzerland, along with its 10 subsidiaries. Tied to Russian oligarch Oleg Deripaska, BitRiver is one of the largest Bitcoin mining hosts in Europe and operates six data centers, with another three under construction. Further in this effort, the European Union is forcing Binance to crack down on Russian users moving assets worth more than $10K.

Rug pulls could soon become an outright felony, as New York lawmakers lobby for new legislation that proposes limits on the ability to found development teams to sell significant percentages of their token holdings within a five-year period. This comes shortly after the rug pull of Frosties, a fraudulent NFT project whose creators were charged last month for looting $1.3M in ETH. This could be a great victory for, not only US investors, but for the entire DeFi community that is often being associated with rug pulls and fraud.

German banking giant Commerzbank has applied for a crypto license, making it the first major bank to move towards cryptocurrencies in the country. Similarly in the UAE, Kraken was granted the license to operate in the emirates, to become the first cryptocurrency exchange to offer direct funding and trading in UAE dirhams against Bitcoin, Ether, and a range of other virtual assets.

DeFi

Near’s long-anticipated native stablecoin USN has finally launched on Mainnet after weeks of excitement, with reports coming out that the project’s efforts led by the Decentral DAO will help offer a range of at least 11% APY - generated via the DAO’s revenue from staking NEAR. Figures will fluctuate based on staking rewards, while USN’s emergency funds will be backed with a treasury of USDT and NEAR reserves. In the same vein, Justin Sun of Tron announced that the network will introduce its own native algorithmic stablecoin named USDD. The new project is similarly expected to offer a 30% base APY, with $10B worth of diversified crypto held in reserves. Interestingly, the risk-free interest rate seems to be unsustainable in hindsight considering Anchor’s protocol challenges in preserving their advertised 20% yield. But as it is too early to assess how feasible these propositions will be, we'll be keeping an eye out on how this situation progresses.

Polygon revealed their latest innovation dubbed supernets. Akin to Avalanche’s subnets, Polygon’s newest feature will simultaneously allow the creations of custom application-specific scalable networks.

Weekly Returns

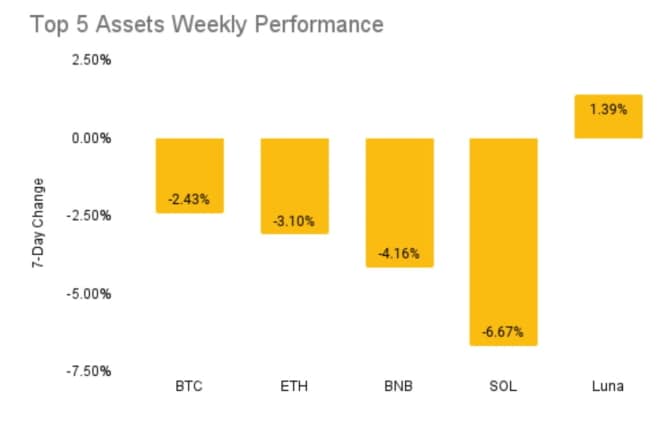

The returns of the top five cryptoassets over the last week were as follows - BTC (-2.43%), ETH (-3.10%), BNB (-4.16%), SOL(-6.67%), Luna (1.39%).

Net Inflows per 21Shares ETP

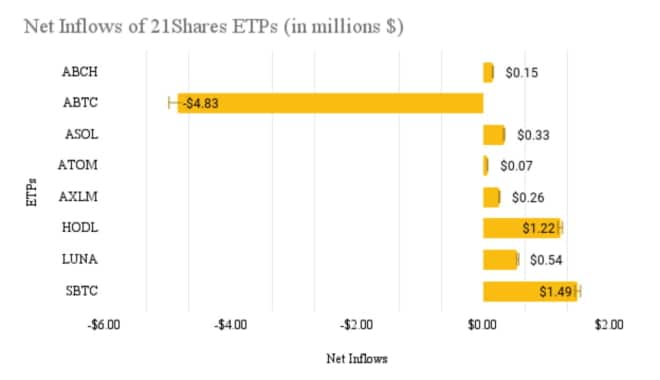

The net outflows of our ETPs amounted to $776K in the past week. Find the breakdown of the inflows and outflows per ETP below.

Media Coverage

We are excited to welcome Karan Chawla, ex-Uber, to our growing team as a VP of Product at 21Shares. The Block picked the news, delving in Karan’s extensive experience. "I think it’s still early days [for crypto] and it’s such a big opportunity. The key for us is going to be velocity. We need to be able to move quickly if there’s an opportunity," Karan told The Block.

Making waves in Australia, Ophelia Snyder was invited on Australian national television to talk about the country’s first spot-Bitcoin ETF issued by 21Shares. You can watch the interview here.

In other news, James Wang, Head of Tokens at 21Shares, shared in an op-ed to BeIN Crypto, on how to make a diversified portfolio. "Perhaps the easiest and most accessible option for many investors would be the rising availability of what are known as ‘index tokens,’" James wrote. "As their name implies, these tokens are a single asset that aggregates investments focused on specific market segments, such as DeFi or layer-1 blockchains."

News

Is the US Air Force Branching into the Metaverse?

What happened?

On Thursday, the United States Air Force submitted to the Patent and Trademark Office, to trademark the word "SpaceVerse." According to the US Air Force’s application, the SpaceVerse is a secure digital metaverse that converges terrestrial and space physical and digital realities and provides synthetic and simulated extended-reality (XR) training, testing, and operations environment

Why does it matter?

With all the uncertainty and regulatory scrutiny that Web 3 is surrounded by today, having a governmental body with the prominence of the US Air Force building its own metaverse is a testament in itself that this vacuum is fertile with proficient use cases beyond gaming and digital art. As we have reiterated in our previous writings and in our last monthly webinar, virtual and augmented reality will open a door to real-life applications, be they education, healthcare, or in this case, space.

It’s important to note that this is not a lonely step in this effort. Last year, Space Force revealed its plans to release NFT versions of patches and coins designed for the launch of one of its vehicles. The Navy also hired Consensus Networks to develop a blockchain-enabled logistics system named HealthNet, to improve medical supply.

BITCOIN KAUFEN? DAS SOLLTEN SIE JETZT WISSEN!

Was beim Einstieg wirklich zählt: Sichere Handelsplätze finden, wichtige Grundlagen und aktuelle Trends verstehen.

Jetzt informieren und fundiert in Bitcoin investierenTop Kryptowährungen

| Bitcoin | 87’882.92126 | 1.32% | Handeln |

| Vision | 0.08715 | 1.63% | Handeln |

| Ethereum | 3’074.37939 | 0.88% | Handeln |

| Ripple | 1.98803 | 1.74% | Handeln |

| Solana | 148.75591 | 0.60% | Handeln |

| Cardano | 0.49024 | 1.83% | Handeln |

| Polkadot | 2.32122 | 0.86% | Handeln |

| Chainlink | 13.80897 | 2.57% | Handeln |

| Pepe | 0.00001 | 1.92% | Handeln |

| Bonk | 0.00001 | 3.44% | Handeln |

Inside Krypto

Ob Industrie 4.0, Luxusgüter oder Internet-Infrastruktur - hier finden Sie aktuelle Anlagetrends mit vielen Hintergrundinformationen und passenden Trendaktien. Jetzt mehr lesen

Börsentag 2025: Silber vor Verdopplung? Rohstoffexperte über die Chancen

Im Experteninterview erklärt Prof. Dr. Torsten Dennin, welche Faktoren die Preise von Gold, Silber, Kupfer, Uran und Agrarrohstoffen treiben – und welche Chancen & Risiken Anleger jetzt kennen sollten.

👉 Was steckt hinter der aktuellen Gold- und Silber-Rallye?

👉 Welche Rohstoffe gelten 2025 als besonders spannend für Investments?

👉 Wie investieren Anlegerinnen und Anleger am besten in Edelmetalle & Rohstoffe?

Erhalte fundierte Einschätzungen, Marktprognosen und Antworten auf spannende Zuschauerfragen rund um Edelmetalle, Minenaktien, ETFs und Rohstofftrends.

👉🏽 Jetzt auch auf BXplus anmelden und von exklusiven Inhalten rund um Investment & Trading profitieren!