|

08.07.2025 12:02:27

|

AMINA Bank: GENIUS Act Explained: Why This Is a Turning Point for Dollar-Backed Stablecoins Like RLUSD

Introduction: A Regulatory Inflection Point

The GENIUS Act - short for Guiding and Establishing National Innovation for U.S. Stablecoins - was officially passed by the U.S. Senate on June 17, 2025, marking a pivotal moment in digital finance policy.

With bipartisan support (68 to 30), the legislation is Washington’s strongest signal yet that it intends to reclaim leadership in a sector long overshadowed by regulatory uncertainty. But this isn’t just another compliance framework. The GENIUS Act represents something deeper: a strategic recalibration of how the U.S. views stablecoins, not only as financial instruments, but as instruments of monetary leadership.

The Act is a clear move to reinforce the global role of the U.S. dollar, using dollar-backed stablecoins as an extension of that power. And the markets responded swiftly.

Stablecoin capitalization surged to $251.7 billion, up 22% year-to-date. Circle, issuer of USDC, saw its stock jump 34% following the announcement. Bitcoin ETFs drew in $388 million in inflows within just 24 hours.

For investors, policymakers, and the industry at large, this legislation was as overdue as it was catalytic. It’s about unlocking the next chapter in U.S. digital asset policy and here's how it has unfolded and the Ripple effect on currently established stablecoins.

The Road to GENIUS: Where It All Began

Three key dynamics propelled the GENIUS Act.

First, geopolitical urgency.

In 2024, stablecoin transactions crossed $27.6 trillion globally, surpassing the combined volume of Visa and Mastercard. At the same time, China’s digital yuan continued expanding its reach across Belt and Road economies, prompting a growing sense of strategic urgency in Washington.

It was clear to the U.S policymakers: supporting market-driven stablecoin innovation wasn’t just about fintech - it was about preserving global dollar dominance.

Second, regulatory maturity.

Fragmented state-level rules had long created friction for institutional players. The GENIUS Act introduced a harmonized framework that enables broader participation from banks, fintechs, and global investors.

Third, political alignment.

Crypto lobbying reached a record 245 million dollars during the 2024 election cycle. Political Action Committees like Fairshake, backed by Coinbase and Ripple, helped shift the conversation in Washington toward innovation-friendly regulation. While causality is difficult to prove, the timing of lobbying efforts and regulatory alignment is noteworthy.

Adding an economic incentive, Treasury Secretary Scott Bessent projected that reserve requirements under the Act could drive over 2 trillion dollars in demand for U.S. Treasuries. Stablecoins are no longer just fintech tools. They are now seen as macroeconomic assets.

Inside the GENIUS Act: A Three-Tiered Framework

The Act introduces a tiered model for stablecoin issuer eligibility.

- Tier 1 includes insured depository institutions launching stablecoin subsidiaries under direct federal oversight.

- Tier 2 allows nonbank entities to qualify through the Office of the Comptroller of the Currency.

- Tier 3 permits state-regulated issuers with less than 10 billion dollars in market capitalization, as long as their state framework meets federal standards.

Entities excluded from participation include DAOs, most fintech startups, and foreign-domiciled issuers not operating under comparable regulatory regimes. This reflects a regulatory preference for mature, well-capitalized, and institutionally structured issuers. However, Section 15 of the Act introduces a reciprocity provision, allowing overseas-regulated stablecoin issuers to participate if their home jurisdiction offers substantially equivalent regulatory safeguards.

Backing requirements are strict. All stablecoins must be backed one-to-one with U.S. dollars, short-term Treasury bills, or other approved high-quality liquid assets. Typically, reserves must be held in segregated custodial accounts and cannot be used as collateral. However, Section 8(c)(2) allows for exceptions via omnibus custodial arrangements, provided issuers meet enhanced transparency and disclosure requirements. Issuers must provide monthly attestations, undergo annual audits, and have CEOs and CFOs certify reserve disclosures. The structure closely mirrors traditional public company reporting standards.

From a compliance perspective, issuers are subject to the Bank Secrecy Act. They must implement full anti-money laundering and know-your-customer procedures, maintain systems to monitor suspicious activity, and retain the technical ability to freeze or burn tokens when legally required. These rules also apply to foreign stablecoin projects operating in U.S. secondary markets.

Issuers are prohibited from paying interest, lending assets, or engaging in proprietary trading, thereby reinforcing the role of stablecoins as transactional instruments rather than yield-bearing financial products. This preserves their status as mediums of exchange rather than speculative or investment instruments.

Winners, Challengers, and Market Realignment

The GENIUS Act creates clear distinctions across the stablecoin landscape.

Circle emerged as an early beneficiary, aided by its historically compliance-oriented posture and preparedness for regulatory shifts. After its IPO in June 2025, which raised 1.1 billion dollars, Circle reached a market capitalisation of 65.15 billion dollars, reflecting strong investor confidence.

Traditional banks, including JPMorgan and Bank of America, now have a regulatory runway to enter the stablecoin space. Several large retailers and tech companies are reportedly exploring integrations as well.

Ripple’s RLUSD is another early mover. Launched under a trust charter granted by New York’s Department of Financial Services (NYDFS), RLUSD is fully backed by cash, U.S. Treasuries, and other government securities. It undergoes third-party audits, maintains segregated custody, and includes compliance controls such as token freezing and clawback mechanisms.

In response to the GENIUS Act’s federal eligibility criteria, Ripple Labs, the parent company behind the XRP Ledger and the RLUSD stablecoin has formally applied for a national banking license with the Office of the Comptroller of the Currency (OCC). Ripple CEO, Brad Garlinghouse confirmed that this move - along with a parallel to secure a Federal Reserve master account through Standard Custody & Trust Company a Ripple subsidiary - is intended to position RLUSD as a federally regulated stablecoin issuer under Tier 2 of the GENIUS Act framework. These steps would enable Ripple to hold RLUSD reserves directly with the Federal Reserve System (FED) enhancing trust, transparency and long-term compliance viability.

Tether, the issuer of USDT, continues to attract regulatory attention regarding reserve disclosures. While it remains outside the GENIUS Act framework for now, its scale and global usage make it a key player in ongoing policy discussions

Market Reaction: Capital Flows and Investor Confidence

Markets responded decisively to the passage of the GENIUS Act, reflecting renewed institutional confidence in compliant digital assets.

Circle’s stock rose by 34% on the day of the Senate vote, closing at $199.59 and reaching an all-time high of $292.77 on June 23. This marked a more than 840% increase since its IPO on June 5, 2025, when it debuted at $31 per share.

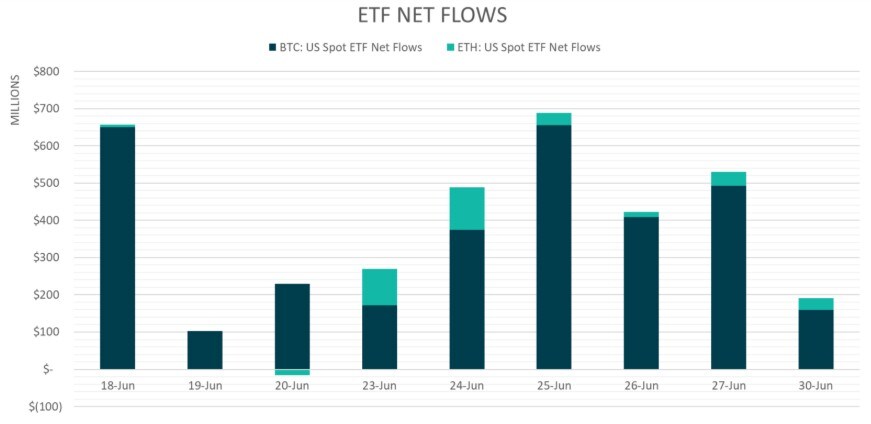

In parallel, spot Bitcoin and Ethereum ETFs recorded over $3.5 billion in combined net inflows between June 18 and June 30, 2025, underscoring strong institutional demand for regulated, dollar-denominated crypto exposure. Bitcoin ETFs led the charge with multiple days exceeding $600 million in inflows, while Ethereum ETFs saw a resurgence with over $300 million during the same period. The surge reflects renewed investor confidence following the GENIUS Act’s passage.

Figure 1: US Spot ETF Net Flows (18th June 2025 to 30th June 2025)

Source: AMINA Bank, Glassnode

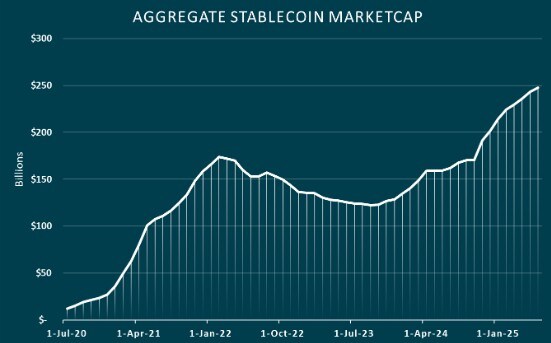

At the same time, the aggregate stablecoin market capitalization reached a record $251.7 billion, representing a 22 per cent increase year-to-date. The surge reflects growing demand for transparent, reserve-backed digital dollars aligned with the GENIUS Act framework.

Figure 2: Aggregate Stablecoin Market Capitalisation (1st July 2020 to 1st July 2025)

Source: AMINA Bank, Artemis Analytics

According to BitPay data, USDC’s share of crypto payments fell from 85 percent in January 2024 to 56 percent in May 2025, while USDT’s share rose to 43 percent. With U.S. regulations now favoring compliant issuers such as Circle, these trends may begin to reverse as trust shifts toward federally aligned alternatives.

International adoption is also gaining traction. As jurisdictions like the European Union, Singapore, and Hong Kong implement parallel regulatory frameworks, U.S.-regulated stablecoins are increasingly well-positioned to serve as trusted global payment instruments.

The GENIUS Act in Global Context

Globally, the GENIUS Act introduces a scalable and adaptable framework that distinguishes itself through its dual-path model and market-based incentives. Compared to the European Union’s Markets in Crypto-Assets Regulation (MiCA), which applies a centralized and prescriptive approach, the U.S. system prioritizes institutional scalability and public-private collaboration. Singapore’s Payment Services Act (PSA) similarly supports innovation through flexible licensing, though at a smaller market scale.

China represents a stark contrast. Its e-CNY model is entirely state-controlled, with no room for private token issuance. In contrast, the GENIUS Act empowers the private sector under strong federal oversight. This is an approach that could shape global digital finance in the coming decade.

The table below summarizes key differences across leading regulatory jurisdictions.

Source: AMINA Bank

Conclusion: Cementing the Digital Dollar

The GENIUS Act marks a significant regulatory shift, laying foundational groundwork for a dollar-backed digital financial system. By embedding stablecoins into the federal financial framework, the Act reinforces their role as durable, compliant, and scalable instruments of U.S. monetary strength. In a landscape of rising multipolar currency dynamics, the legislation positions the digital dollar as a contender for continued relevance in global finance. Stablecoins, once peripheral, are now emerging as key components in the evolving financial architecture.

Top Kryptowährungen

- 1T

- 1W

- 1M

- 3M

- 1J

- 3J

Inside Krypto

Ob Industrie 4.0, Luxusgüter oder Internet-Infrastruktur - hier finden Sie aktuelle Anlagetrends mit vielen Hintergrundinformationen und passenden Trendaktien. Jetzt mehr lesen

„Silber schlägt Gold?“ – Der geheime Favorit 2025! mit Prof. Dr. Torsten Dennin

💥 Silber 2025: Das unterschätzte Investment?

Im heutigen BX Swiss TV Experteninterview spricht Prof. Dr. Torsten Dennin (CIO der Asset Management Switzerland AG) darüber, warum Silber aktuell das vielleicht spannendste Rohstoff-Investment überhaupt ist.

Gemeinsam mit Olivia Hähnel (BX Swiss) beantwortet er folgende Fragen:

👉 Ist Silber der neue Geheimfavorit gegenüber Gold?

👉 Welche Rolle spielt der Boom bei Solar und Hightech für die Preisentwicklung?

👉 Und wie kann man als Anleger konkret profitieren – mit welchen Chancen und Risiken?

🔍 Das erwartet euch im Interview:

◽ Aktuelle Marktsituation und Hintergründe zum Silberpreis

◽ Gold vs. Silber: Unterschiede & Investmentpotenzial

◽ Industrielle Treiber: Solar, Energiewende, Zukunftstechnologien

◽ Angebot, Nachfrage & Lagerbestände: Warum der Markt im Defizit ist

◽ Investieren in Silber: physisch, ETFs, Zertifikate, Minenaktien

◽ Chancen & Risiken von Explorationsunternehmen vs. Produzenten

◽ Strategien für sicherheitsorientierte Anleger

◽ Prognose: 45–50 USD – oder mehr?

👉🏽 Jetzt auch auf BXplus anmelden und von exklusiven Inhalten rund um Investment & Trading profitieren!