|

05.06.2025 17:01:02

|

AMINA Bank: Michael Saylor’s MicroStrategy Bitcoin Trade

In this edition of the Crypto Market Monitor, we walk through this trade in plain English. Please note that in this piece, we use Strategy and MicroStrategy interchangeably, that they both refer to the same entity. We break down how the deal is structured, who wins if it works, the pitfalls that could sting those involved and the key signals investors should watch to see whether this gamble moves the wider Bitcoin market. Let’s dive in.

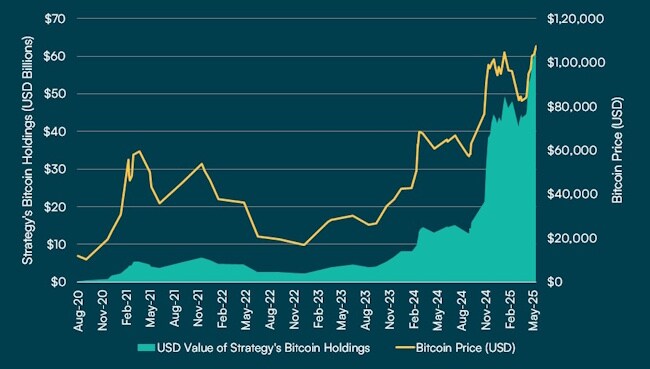

How did Strategy reach here and how much Bitcoin do they hold? Strategy has adopted Bitcoin as its primary reserve asset. Instead of holding traditional cash or short-term investments, it holds a substantial portion of its balance sheet in Bitcoin. It began with an initial $250 million purchase of 21,454 BTC in August 2020 and was soon followed by additional large purchases, funded through a mix of internal cash and external financing. It accumulated BTC throughout the years that followed. Its most ambitious plan announcement came in October 2024, dubbed the 21/21 Plan, with the aim to raise a total of $42 billion ($21 billion via equity and $21 billion via debt) to accumulate additional Bitcoin worth this amount by 2027.

This was kicked off by massive accumulation in late 2024 when the firm bought well over 200K BTC in just a few months, bringing its total to above 500K BTC by the end of December 2025. So how much Bitcoin does MicroStrategy own, you ask? At the time of writing this article in May 2025, the company holds over 580K BTC (currently valued at over $63.52 billion) at an average cost basis of just over $69K per BTC held. The company has essentially converted itself into a Bitcoin investment vehicle while still operating its legacy enterprise software business on the side.

Figure 1: Strategy’s Bitcoin holdings over time. The firm currently holds over 580K BTC, $62 billion. (over 2.7% of Bitcoin’s total supply)

Source: AMINA Bank, Glassnode (29 May 2025)

How exactly is Strategy buying so much Bitcoin?

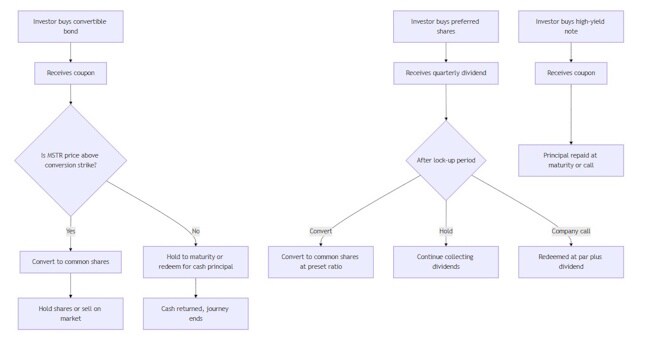

The mechanics of this strategy involve buying Bitcoin with virtually every source of capital available: the company uses excess corporate cash flows, issues new equity and has issued several rounds of debt (both convertible bonds and traditional secured notes) specifically to fund Bitcoin purchases.

Once Strategy raises cash through low-interest convertible bonds (bonds that can be converted into common stocks at holder’s discretion during the bond’s life), steady share sales under its at-the-market program or standard high-yield notes. It then routes the funds to an institutional trading desk such as Coinbase Prime and buys Bitcoin in several smaller blocks to avoid moving the market. The coins are then transferred to secure, multi-signature cold-storage wallets. In short, the capital-markets team secures low-cost dollars, and the treasury team promptly turns those dollars into Bitcoin for long-term safekeeping.

Figure 2: The value proposition for parties on both sides of Strategy’s Bitcoin trade

Source: AMINA Bank

The high volatility of the MicroStrategy stock implies relatively high values for options on the stock. Consequently, convertible bonds with an embedded call option can pay comparatively low coupons. This allows MicroStrategy to access financing with low cash drain.

MicroStrategy does not trade or hedge these holdings. It has a simple buy-and-hold mandate. Bitcoin is now treated as a strategic long-term treasury reserve, not a short-term investment. In effect, MicroStrategy is willing to substantially dilute its stock and take on significant debt in order to acquire as much Bitcoin as possible, banking on the asset’s long-term appreciation. (MicroStrategy’s new branding as Strategy with a Bitcoin-themed logo too underscores how integral Bitcoin now is to its identity.

The Why behind Strategy buying so much Bitcoin

Michael Saylor, the Executive Chairman of Microstrategy and other spokespersons have articulated a clear rationale for their Bitcoin-as-reserve strategy, rooted in both macroeconomic concerns and a fundamental belief in Bitcoin’s properties. Let’s break down the key reasons they’ve cited:

- Protecting shareholder value from currency debasement: In 2020, Saylor grew concerned about the rapid expansion of the money supply, near-zero interest rates, and inflation risks from global stimulus. He estimated MicroStrategy’s cash reserves were losing millions in value annually. Traditional safe assets like Treasuries offered little protection, so the board spent months seeking a solution to the long-term risk of currency debasement. Bitcoin emerged as the answer.

- Bitcoin as digital gold and a store of value: Saylor views Bitcoin as digital gold - scarce, secure and designed to outlast fiat currencies. With a fixed 21 million supply, global adoption and resilience, Bitcoin is seen as a hedge against inflation and a superior store of value. MicroStrategy believes Bitcoin’s scarcity and network effects will drive long-term appreciation. For those interested in reading more about Bitcoin’s case as digital gold and a store of value, check out our recent article on Bitcoin’s investment case in 2025.

- Long-term appreciation of shareholder value: MicroStrategy’s Bitcoin strategy aims to maximise long-term shareholder value, shifting treasury assets from cash to Bitcoin. The board sees Bitcoin as a strategic investment with growth potential, not just a defensive hedge.

- Ideological and technological belief: Saylor sees Bitcoin growing like the early days of the Internet. He calls it digital energy: a way to store value that doesn’t lose strength over time. To him, Bitcoin is the truth in money and a safe place for the long term.

- Confidence in Bitcoin’s maturity: By 2020, Bitcoin had matured with secure custody, insurance, audits and regulatory clarity. Its resilience, decade-long track record, growing adoption and endorsements from major investors gave Strategy confidence that Bitcoin was here to stay and would only get stronger.

Who benefits from Strategy’s Bitcoin trade?

The most obvious beneficiaries of this trade are the insiders. Michael Saylor’s net worth, tied to Strategy, surged from roughly $500 million to $10 billion at peak between August 2020 and December 2024. Executives like CEO Phong Le and board members too benefited from the rising MicroStrategy stock value and favorable capital raises.

Retail shareholders too benefitted immensely. Early buyers saw up to 20x gains. Even mid-2022 lows ($14 per share post a stock split) rebounded to current levels of close to $400 per share. Bitcoin-focused shareholders gained both from stock appreciation and premium-driven Bitcoin accumulation.

Figure 3: Strategy’s market capitalisation saw a phenomenal rally since adopting Bitcoin as a reserve asset

Source: AMINA Bank, TradingView (30 May 2025)

A major positive effect of this trade was on Bitcoin’s ecosystem and investor base. Strategy’s 580k+ BTC purchases reduced available supply, pushed prices up and boosted Bitcoin’s legitimacy. Saylor’s evangelism helped drive corporate interest. Regulatory clarity (for example the Financial Accounting Standard Board’s December 2023 crypto fair value rule requiring companies to measure certain crypto assets at fair value and reflect changes in fair value in net income) partly arose from MicroStrategy’s influence. Sellers during MicroStrategy’s buying benefited from higher liquidity and prices.

Additionally, convertible debt holders of MicroStrategy have experienced extraordinary returns. These investors, ranging from institutional bondholders to sophisticated arbitrage funds, have capitalised on one of the most successful corporate Bitcoin plays in history through carefully structured convertible securities that provided both downside protection and explosive upside potential. Let’s look at both of these groups.

- Holders looking to convert: MicroStrategy’s convertible bondholders reaped significant gains by strategically converting debt into equity as Bitcoin-powered stock rallies sent MSTR shares soaring. For example, the 2020 convertible notes (a $650 million raise) offered a 0.75% coupon with a $397.99 per share conversion price, just a 37.5% premium over the stock’s $289.45 price at issuance. By 2021, MSTR’s stock had surged above $1,300, allowing bondholders to convert debt into equity and sell for 3x+ returns. Another example is where the 2021 convertible notes (a $1.05 billion raise) had a 0% coupon and a conversion price of $1,432 per share. As MSTR rebounded past $1,500 in 2024, those holding these notes could also convert and lock in profits.

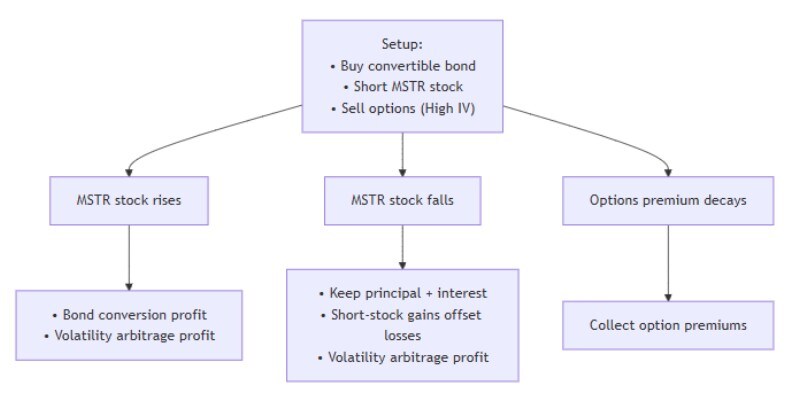

In total, MicroStrategy has raised $8.2 billion through convertible debt, all earmarked for Bitcoin purchases. With Bitcoin and MSTR surging to higher highs, this group is sitting on substantial unrealised gains. This structure gave bondholders equity-like upside while preserving downside protection if conversion wasn’t profitable, as long as MSTR is able to pay back the notional of the convertible bonds. This set of investors profit from Bitcoin’s rise without direct crypto exposure, while MicroStrategy accessed ultra-low-cost capital (0-0.75% rates) to fuel its Bitcoin accumulation strategy. - Hedge Funds: Sophisticated hedge funds have benefitted from MicroStrategy's convertible debt strategy through arbitrage. Major institutional players including Calamos Advisors, Linden Advisors, Context Capital, Graham Capital and Millennium Management have purchased these convertible bonds to execute profitable trading strategies. These hedge funds utilise convertible notes in arbitrage trades using options that exploit the surging volatility of MicroStrategy stock while neutralizing directional exposure.

The arbitrage strategy typically involves purchasing convertible bonds while simultaneously shorting the underlying stock and trading options to create delta-neutral positions. As MicroStrategy's stock price volatility increased due to Bitcoin's price movements and the company's aggressive accumulation strategy, these arbitrage opportunities became increasingly profitable. The high implied volatility (IV) in MicroStrategy's options market allowed hedge funds to generate substantial returns regardless of the stock's direction.

Figure 4: A visual breakdown of the how hedge funds have benefited from Strategy’s Bitcoin trade

Source: AMINA Bank

The Risks of Strategy’s Bitcoin trade

While many have profited from this strategy, the trade carries risks and potential downsides for certain stakeholders. We explore them below.

Shareholders diluted by issuances: MicroStrategy’s aggressive share sales dilute existing shareholders. If Bitcoin rises, dilution is manageable. But if BTC falls, these new shares dilute the pie without adding value. There’s a risk that dilution could erode long-term shareholder value. So far, BTC’s price rise has offset the dilution, but the risk remains.

Bondholders (crash scenario risk): Bondholders (both straight and convertible) have been fine so far but if Bitcoin collapses and Strategy can’t raise equity, bondholders could face default risk. Senior notes (like the $500 million due 2028) are backed by Strategy’s assets, most of which is Bitcoin. In a market downturn, they might recover less than expected.

Future capital providers (Preferred Stock Buyers): MicroStrategy is raising capital via preferred shares (roughly 8-10% yield) to fund more Bitcoin purchases. If the price of Bitcoin rises, preferred investors benefit. But if BTC stagnates or falls, the company may struggle to pay dividends without further equity sales creating dilution risk. Late-stage capital providers buying in at BTC’s local (or even cycle) top prices face the risk of a zero-sum trade: value may flow to earlier shareholders or BTC sellers, while they hold devalued shares.

Profitability: The firm’s financials shifted noticeably following its Bitcoin pivot. While its total revenue has hovered around the $500 million mark from 2018 to 2024, the company's profitability took a hit in recent years. Its net income had been consistently positive for over a decade and a half until 2019. This turned negative in 2020 and has remained so till date. The exception was 2023 - a year when profit came from a huge $554 million deferred-tax benefit, a $45 million gain on early debt repayment and sharply lower Bitcoin impairment charges, which together outweighed its still-negative core operating results. Strategy’s pivot to Bitcoin coincided with a steep deterioration in EBITDA, suggesting the Bitcoin strategy weighed heavily on its operating profitability due to impairment charges on its holdings.

For the uninitiated, here’s what impairment charges mean and why they’re such a huge factor for Strategy: Impairment is an accounting rule that requires a company to reduce the value of an asset on its balance sheet if that asset’s market value drops below what the company paid for it. This reduction is recorded as a loss (called an impairment charge) on the company’s income statement. (even if the company hasn’t actually sold the asset) For Strategy, impairment charges are so large because they hold a massive amount of Bitcoin. Whenever Bitcoin’s price falls below the price at which they bought it (even temporarily), they must record this loss. The accounting rules do not allow them to reverse these losses if Bitcoin’s price later recovers. Because Bitcoin’s price is very volatile, even short-lived dips can trigger huge impairment charges, adding up to hundreds of millions of dollars in reported losses, even if the overall value of their Bitcoin eventually rebounds.

Dilution and Financing Risk: MicroStrategy’s future strategy (21/21 Plan) relies on constantly raising new money from investors by selling shares or bonds, then using that money to buy more Bitcoin. The company’s stock usually trades at a premium above the value of its Bitcoin holdings (called NAV, or Net Asset Value). This premium is crucial since it lets MicroStrategy issue new shares at high prices, so when it uses the proceeds to buy Bitcoin, each existing shareholder actually ends up owning more Bitcoin per share.

If that premium disappears and the stock trades at or below the value of its Bitcoin holdings (NAV), raising new money by selling shares becomes much less attractive. Why? Because selling new shares at no premium (or a discount) means each new share just gets a slice of the existing Bitcoin, diluting everyone’s share of Bitcoin per share. In other words, instead of growing, each shareholder’s claim on the company’s Bitcoin shrinks.

If capital markets stop buying new shares or bonds, or if the premium vanishes, MicroStrategy would struggle to raise fresh funds without hurting current shareholders. This would make it much harder to keep buying more Bitcoin or even to pay dividends and debts, putting the company’s entire strategy at risk. And we already see hints of this: with more Bitcoin ETFs and publicly traded instruments simplifying access to BTC for retail, the uniqueness of MSTR could diminish, possibly shrinking the premium as investors have alternatives. Additionally, if credit conditions tighten (risk free interest rates or MSTR’s credit spread go higher), issuing more debt could become expensive or unviable. The question remains: Can Strategy continue to raise funds?

Liquidity Analysis Because its filings never mention a credit line, let's assume for a moment that Strategy does not have any traditional revolving credit facilities. Instead, the company relies exclusively on capital markets (issuing convertible bonds and preferred stock, as mentioned earlier) to fund its operations and Bitcoin purchases. Because it has no bank credit lines, this approach exposes Strategy to substantial liquidity risk: if market conditions deteriorate, it would lack other sources of short-term funding. It therefore is important to do an analysis of the company’s current liquidity conditions with respect to its Bitcoin-related activities. Let’s take a look.

Cash and Liquid Assets

As of December 2024, Strategy held close to $40 million in cash on its balance sheet. Beyond this, its only material liquid asset is its Bitcoin position: currently valued at roughly $60.7 billion. However, Bitcoin’s inherent volatility means that, in a liquidity crisis, Strategy would be forced to sell Bitcoin as its sole major source of liquidity. With no other sizeable liquid holdings, any sudden need for cash could compel a distressed sale of bitcoin at unfavourable prices.

Convertible Bonds: Strategy has three main convertible bond issues outstanding, totaling $5.875 billion:

- A $875 million bond due in September 2028, which carries a small interest payment (0.625 percent per year).

- A $3 billion bond due in December 2029 with no regular interest payments.

- A $2 billion bond due in March 2030, also with no regular interest.

Each bond can be converted into Strategy shares at a predetermined strike price if the share price rises high enough. At today’s share price (around $370), the 2028 bond is already in the money, meaning holders could convert right away and receive shares worth more than the underlying debt. By contrast, the 2029 bond would require MicroStrategy’s stock to climb to about $672 per share before conversion makes sense for the holders and the 2030 bond would need about $433 per share. If the stock’s price doesn’t hit these levels or if bondholders choose not to convert, Strategy must repay the full amount in cash on each bond’s maturity date. That is $875 million in 2028, $3 billion in 2029 and $2 billion in 2030. And because Strategy only has $38 million of cash available today, covering any of those lump-sum repayments would force a large sale of bitcoin.

Preferred Stock: Strategy also has two series of preferred stock outstanding.

- Strike Preferred shares (STRK): 7.3 million shares paying an 8% annual dividend, which equals $58.4 million per year.

- Strife Preferred shares (STRF): 8.5 million shares paying a 10% annual dividend, which equals $85 million per year.

Therefore, these $143.4 million in annual dividend payments place heavy pressure on its limited cash. Even if Strategy used all of its $38 million in cash, it would still need another $105 million to make one year’s preferred-dividend payment in full. Over time, if the company cannot generate profits or raise fresh money, it risks falling behind on these dividend payments, requiring restructuring of the debt and preferred shares, or forced asset sales.

Table: Strategy’s current Bitcoin-related liquidity conditions

Source: Strategy’s Q4 2024 filing and Q1 2025 results, AMINA Bank

Key factors to watch

To gauge the health of Strategy’s Bitcoin wager, it’s important for investors to keep an eye on a few headline numbers. The most important of all would be to watch Bitcoin’s spot price, especially any sustained moves above or below the firm’s $69K average cost. Next, tracking the premium or discount between MSTR’s share price and its per-share Bitcoin net asset value (NAV) is key. With the current NAV multiplier standing at 1.64, a widening premium fuels cheap equity raises, while a collapse signals skepticism.

Figure 5: NAV multiplier (MSTR Market Cap divided by the firm’s total Bitcoin holdings)

Source: Bitcoin Treasuries (29 May 2025), online source available at Microstrategy, Inc.

Third, follow the cadence and size of new BTC purchases (or any surprise sales). This is because continued accumulation shows both conviction and access to capital. Lastly: fresh equity, convertible bond or preferred stock offerings. The premium at which they raise fresh funds and how successful every subsequent round could be early indicators of where BTC is headed and how sustainable Strategy’s trade is. Taken together, these signals could reveal whether Strategy’s buy-borrow-buy flywheel is still spinning or about to seize up.

Conclusion

MicroStrategy turned a steady software company into a near-pure Bitcoin play by swapping its cash for BTC and borrowing to buy more. That gamble has paid off so far, sending the stock up many times over whenever Bitcoin rises, but it also makes the company’s fate swing with every big move in BTC price. Early investors, Michael Saylor and the wider Bitcoin crowd have come out ahead, while anyone buying at peaks (or if Bitcoin ever sinks below the firm’s $69K cost basis) could feel real pain. Cheap zero-coupon convertible bonds and share sales at high prices have kept the buying spree going, yet the same debt and dilution could bite hard in a long downturn or if tougher rules show up.

By going first, MicroStrategy showed other firms and even a few governments that holding Bitcoin on the balance sheet is possible. Time will tell whether this becomes a new norm for treasuries or a cautionary tale about betting the house on one volatile asset.

Disclaimer - Research

This document has been prepared by AMINA Bank AG ("AMINA") in Switzerland. AMINA is a Swiss bank and securities dealer with its head office and legal domicile in Switzerland. It is authorized and regulated by the Swiss Financial Market Supervisory Authority (FINMA).

This document is published solely for educational purposes; it is not an advertisement nor is it a solicitation or an offer to buy or sell any financial investment or to participate in any particular investment strategy. This document is for distribution only under such circumstances as may be permitted by applicable law. It is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or would subject AMINA to any registration or licensing requirement within such jurisdiction.

No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained in this document, except with respect to information concerning AMINA. The information is not intended to be a complete statement or summary of the financial investments, markets or developments referred to in the document. AMINA does not undertake to update or keep current the information. Any statements contained in this document attributed to a third party represent AMINA's interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party.

Any prices stated in this document are for information purposes only and do not represent valuations for individual investments. There is no representation that any transaction can or could have been affected at those prices, and any price(s) do not necessarily reflect AMINA’s internal books and records or theoretical model-based valuations and may be based on certain assumptions. Different assumptions by AMINA or any other source may yield substantially different results.

Nothing in this document constitutes a representation that any investment strategy or investment is suitable or appropriate to an investor’s individual circumstances or otherwise constitutes a personal recommendation. Investments involve risks, and investors should exercise prudence and their own judgment in making their investment decisions. Financial investments described in the document may not be eligible for sale in all jurisdictions or to certain categories of investors. Certain services and products are subject to legal restrictions and cannot be offered on an unrestricted basis to certain investors. Recipients are therefore asked to consult the restrictions relating to investments, products or services for further information. Furthermore, recipients may consult their legal/tax advisors should they require any clarifications.

At any time, investment decisions (including whether to buy, sell or hold investments) made by AMINA and its employees may differ from or be contrary to the opinions expressed in AMINA research publications.

This document may not be reproduced, or copies circulated without prior authority of AMINA. Unless otherwise agreed in writing AMINA expressly prohibits the distribution and transfer of this document to third parties for any reason. AMINA accepts no liability whatsoever for any claims or lawsuits from any third parties arising from the use or distribution of this document.

Research will initiate, update and cease coverage solely at the discretion of AMINA. The information contained in this document is based on numerous assumptions. Different assumptions could result in materially different results. AMINA may use research input provided by analysts employed by its affiliate B&B Analytics Private Limited, Mumbai. The analyst(s) responsible for the preparation of this document may interact with trading desk personnel, sales personnel and other parties for the purpose of gathering, applying and interpreting market information. The compensation of the analyst who prepared this document is determined exclusively by AMINA.

BITCOIN KAUFEN? DAS SOLLTEN SIE JETZT WISSEN!

Was beim Einstieg wirklich zählt: Sichere Handelsplätze finden, wichtige Grundlagen und aktuelle Trends verstehen.

Jetzt informieren und fundiert in Bitcoin investierenTop Kryptowährungen

| Bitcoin | 88’281.44777 | 1.78% | Handeln |

| Vision | 0.08808 | 2.71% | Handeln |

| Ethereum | 3’106.84875 | 1.94% | Handeln |

| Ripple | 2.02194 | 3.47% | Handeln |

| Solana | 150.87114 | 2.03% | Handeln |

| Cardano | 0.49071 | 1.93% | Handeln |

| Polkadot | 2.31735 | 0.69% | Handeln |

| Chainlink | 13.95799 | 3.68% | Handeln |

| Pepe | 0.00001 | 2.65% | Handeln |

| Bonk | 0.00001 | 7.60% | Handeln |

Inside Krypto

Ob Industrie 4.0, Luxusgüter oder Internet-Infrastruktur - hier finden Sie aktuelle Anlagetrends mit vielen Hintergrundinformationen und passenden Trendaktien. Jetzt mehr lesen

Börsentag 2025: Silber vor Verdopplung? Rohstoffexperte über die Chancen

Im Experteninterview erklärt Prof. Dr. Torsten Dennin, welche Faktoren die Preise von Gold, Silber, Kupfer, Uran und Agrarrohstoffen treiben – und welche Chancen & Risiken Anleger jetzt kennen sollten.

👉 Was steckt hinter der aktuellen Gold- und Silber-Rallye?

👉 Welche Rohstoffe gelten 2025 als besonders spannend für Investments?

👉 Wie investieren Anlegerinnen und Anleger am besten in Edelmetalle & Rohstoffe?

Erhalte fundierte Einschätzungen, Marktprognosen und Antworten auf spannende Zuschauerfragen rund um Edelmetalle, Minenaktien, ETFs und Rohstofftrends.

👉🏽 Jetzt auch auf BXplus anmelden und von exklusiven Inhalten rund um Investment & Trading profitieren!