|

05.07.2024 11:28:03

|

AMINA Bank: Ethereum: Beyond ETFs

Anticipation of this event is already evident in the market, with ETH ETP (Exchange-Traded Product) outflows reaching a three-year high. Over the past two weeks alone, withdrawals from these products have surged to $119 million, signaling strong investor interest in direct ETH exposure ahead of the ETF launch.

Our analysis today explores recent market movements and technological developments for the world's second-largest cryptocurrency.

Current Market Status

As of this writing, Ethereum trades at approximately $3,200. The asset has experienced a 5% decrease in the last 24 hours and a 15% decline over the past month. However, it's important to note that since the market's recovery in 2024, Ethereum has seen a 40% increase in value.

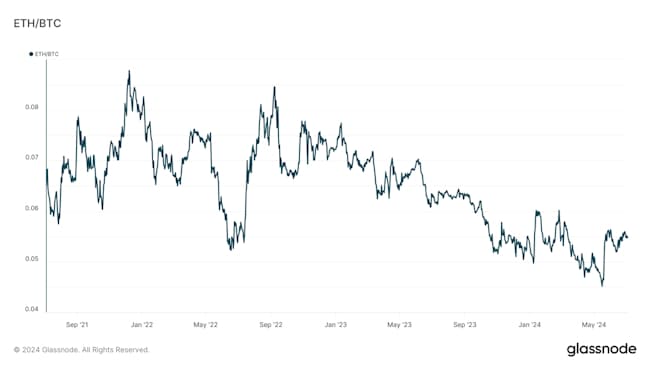

The ETH/BTC ratio reached its lowest point in three years this May, preceding the approval of ETH spot ETF filings. While this ratio has since improved, it remains 14% lower than its position one year ago.

Figure 1: ETH/BTC

Source: AMINA Bank, Glassnode

Market Downturn Analysis

The recent market downturn can be attributed to two primary factors:

1. The redistribution of approximately 140,000 Bitcoins (valued at $8.144 billion) from the Mt. Gox settlement.

2. A noticeable decrease in investor engagement, which can be attributed to:

- Investor apathy following periods of heightened excitement.

- Prolonged sideways price action, leading to reduced trading activity.

- The absence of major near-term catalysts, as significant events like the Bitcoin halving and ETF approvals are now in the past.

It's worth noting that Ethereum maintains an 82% price correlation with Bitcoin over the last 90 days, indicating that broader market trends significantly influence its performance.

Bitcoin ETF Dynamics

In the past week, spot Bitcoin ETFs have seen an influx of approximately $1 billion. However, the market's response to these inflows has been muted. This can be attributed to the implementation of a cash and carry trading strategy, where investors are simultaneously shorting their ETF holdings in the CME futures market. This strategy is evidenced by the increased open interest in CME futures.

Figure 2: ETH and BTC Futures Open Interest

Source: AMINA Bank, Glassnode

ETH ETF Situation

On May 23, the SEC approved 19b-4 forms for eight spot ETH ETFs, marking the first step in a two-part approval process. Issuers are now awaiting the effectiveness of their S-1 statements, the final hurdle before trading can commence. Several prominent firms, including Bitwise and VanEck, have filed amended S-1 statements, with Bitwise notably offering to waive the sponsor fee for the first $500 million in assets, while VanEck also plans initial fee waivers. These competitive moves suggest a keen interest in capturing early market share.

Macroeconomic Considerations

While cryptocurrency often operates independently of traditional markets, several macroeconomic factors could potentially impact its performance:

- The possibility of a pro-crypto government in the United States.

- Expectations of interest rate cuts in September.

Historical data suggests that June typically experiences lower volatility in the crypto market, often followed by increased activity in the latter half of the year.

Regarding Mt. Gox Bitcoin distribution, a report from Galaxy Digital estimates that no more than 65,000 BTC will enter the liquid market supply, potentially mitigating the impact on market dynamics.

Ethereum Ecosystem Developments

Post Dencun (EIP 4844) Upgrade in March:

- Transaction fees paid by rollups have decreased from 12% to less than 1% of mainnet fees.

- In effect of low data posting costs of L2s, Ethereum has returned to an inflationary state, with new ETH issuance surpassing the burn rate from EIP-1559.

- Bot-related and Telegram-based smart contracts have seen the most substantial growth in fee generation.

- Active addresses on Ethereum Layer 2 solutions, particularly Arbitrum, have grown significantly following the implementation of EIP-4844.

- MEV-driven activity has increased from 8% to 14% of transaction fees. Direct trading fees have risen from 20% to 36%

Layer 2 Total Value Locked (TVL) has increased by 2.4x over the past six months. Notable growth has been observed in Base and Blast, though Blast's growth may be influenced by anticipated token airdrops.

TradFi Interest:

- Integration of MetaMask with Robinhood trading platform, potentially expanding Ethereum's accessibility to a broader user base.

- Reddit revealed Bitcoin and Ethereum purchases for its reserves, demonstrating growing institutional interest in cryptocurrencies.

- UBS Hong Kong tested tokenized assets on Ethereum, further validating the platform's potential for traditional finance applications.

- BlackRock launched tokenized RWA funds on Ethereum, representing a major step towards institutional adoption of blockchain technology.

Future Upgrades: Pectra

Ethereum's next significant upgrade, Pectra, is anticipated in Q4 2024 or Q1 2025. Spikes in Ethereum open interest often follow important milestones and upgrades. Key improvements in Pectra include:

- EIP-7002 and EIP-7251: EIP-7251 proposes to raise the maximum validator stake from 32 ETH to 2048 ETH, which could lead to more efficient network operation and potentially reduce the total number of validators needed.

- EIP-7524: Building on the success of the Dencun upgrade, EIP-7524 is expected to introduce additional optimizations for rollups, potentially leading to even lower fees and higher transaction throughput on Layer 2 solutions.

- EIP-7702: The primary goal of EIP-7702 is to allow regular Ethereum accounts (also known as Externally Owned Accounts or EOAs) to behave like smart contract wallets under certain conditions. With EIP-7702, users will be able to perform complex operations in a single transaction, which previously required multiple steps or a smart contract wallet. This will lead to enhanced experience of Dapps.

Conclusion

The growing interest from traditional finance institutions, exemplified by BlackRock's entry into tokenized real-world assets on Ethereum, signals a potential shift towards greater institutional adoption. This trend, coupled with the ongoing development of Layer 2 solutions, positions Ethereum at the forefront of the blockchain scalability race.

Disclaimer

This document is provided by AMINA Bank AG ("AMINA") and is intended for educational and informational purposes. AMINA’s weekly Crypto Market Monitor is not intended for distribution in any jurisdiction where such distribution would be prohibited. Furthermore, it is not aimed at any person or entity residing in such jurisdiction. It does not constitute an offer or a recommendation to subscribe, purchase, sell or hold any security or financial instrument. The document contains the opinions of AMINA as at the date of issue, which do not take into account an individual’s circumstances and objectives. AMINA does not make any representation that any investment or strategy is suitable or appropriate to individual circumstances or that any investment or strategy constitutes personalized investment advice. Some investment products and services may be subject to legal and regulatory restrictions or may not be available worldwide on an unrestricted basis. The information and analysis contained in this Crypto Market Monitor are based on sources considered as reliable. AMINA makes its best efforts to ensure the timeliness, accuracy, and comprehensiveness of the information contained in this document. Nevertheless, all information indicated herein may change without prior notice.

BITCOIN KAUFEN? DAS SOLLTEN SIE JETZT WISSEN!

Was beim Einstieg wirklich zählt: Sichere Handelsplätze finden, wichtige Grundlagen und aktuelle Trends verstehen.

Jetzt informieren und fundiert in Bitcoin investierenTop Kryptowährungen

| Bitcoin | 70’205.41071 | 3.40% | Handeln |

| Vision | 0.06673 | 5.41% | Handeln |

| Ethereum | 2’377.43307 | 5.85% | Handeln |

| Ripple | 1.51784 | 5.46% | Handeln |

| Solana | 100.97755 | 6.30% | Handeln |

| Cardano | 0.30040 | 7.21% | Handeln |

| Polkadot | 1.48125 | 5.95% | Handeln |

| Chainlink | 10.03411 | 5.63% | Handeln |

| Pepe | 0.00000 | 11.26% | Handeln |

| Bonk | 0.00001 | 8.60% | Handeln |

Inside Krypto

Ob Industrie 4.0, Luxusgüter oder Internet-Infrastruktur - hier finden Sie aktuelle Anlagetrends mit vielen Hintergrundinformationen und passenden Trendaktien. Jetzt mehr lesen

Krypto-Crash oder Einstiegs-Chance? – Bernhard Wenger von 21Shares zu Gast im BX Morningcall

Im BX Morningcall spricht Krypto-Experte Bernhard Wenger von @21shares über seinen Weg vom klassischen ETF-Geschäft in die Welt der Krypto-ETPs und erklärt, warum Bitcoin & Co. längst nicht ausgereizt sind. Er beleuchtet den Wandel von einem vorwiegend retailgetriebenen Markt hin zu immer mehr institutionellen Investoren, die über regulierte, physisch besicherte Produkte wie Bitcoin- und Krypto-ETPs investieren. Themen sind unter anderem Volatilität und „Krypto-Winter“, strenge Compliance- und Geldwäschereiregeln, Kostenstrukturen, Unterschiede im DACH-Raum sowie die Rolle des neuen US-Bitcoin-ETFs und des strategischen Investors FalconX für die nächste Wachstumsphase von 21Shares.

👉🏽 https://bxplus.ch/bx-musterportfolio/