| Kurse + Charts + Realtime | News + Analysen | Fundamental | Unternehmen | zugeh. Wertpapiere | Aktion | |

|---|---|---|---|---|---|---|

| Kurs + Chart | Chart (gross) | News + Adhoc | Bilanz/GuV | Termine | Strukturierte Produkte | Portfolio |

| Times + Sales | Chartvergleich | Analysen | Schätzungen | Profil | Trading-Depot | Watchlist |

| Börsenplätze | Realtime Push | Kursziele | Dividende/GV | |||

| Historisch | Analysen | |||||

|

09.06.2025 07:00:00

|

TGS and Oseberg Partner to Integrate Lease Data into Well Data Analytics Platform

HOUSTON, Texas (09 June 2025) – TGS, a global leader in energy data and intelligence, has announced a strategic partnership with Oseberg, a premier provider of lease and regulatory data for the energy sector. This collaboration brings Oseberg lease data attributes into TGS’ Well Data Analytics (WDA) platform for enhanced analysis.

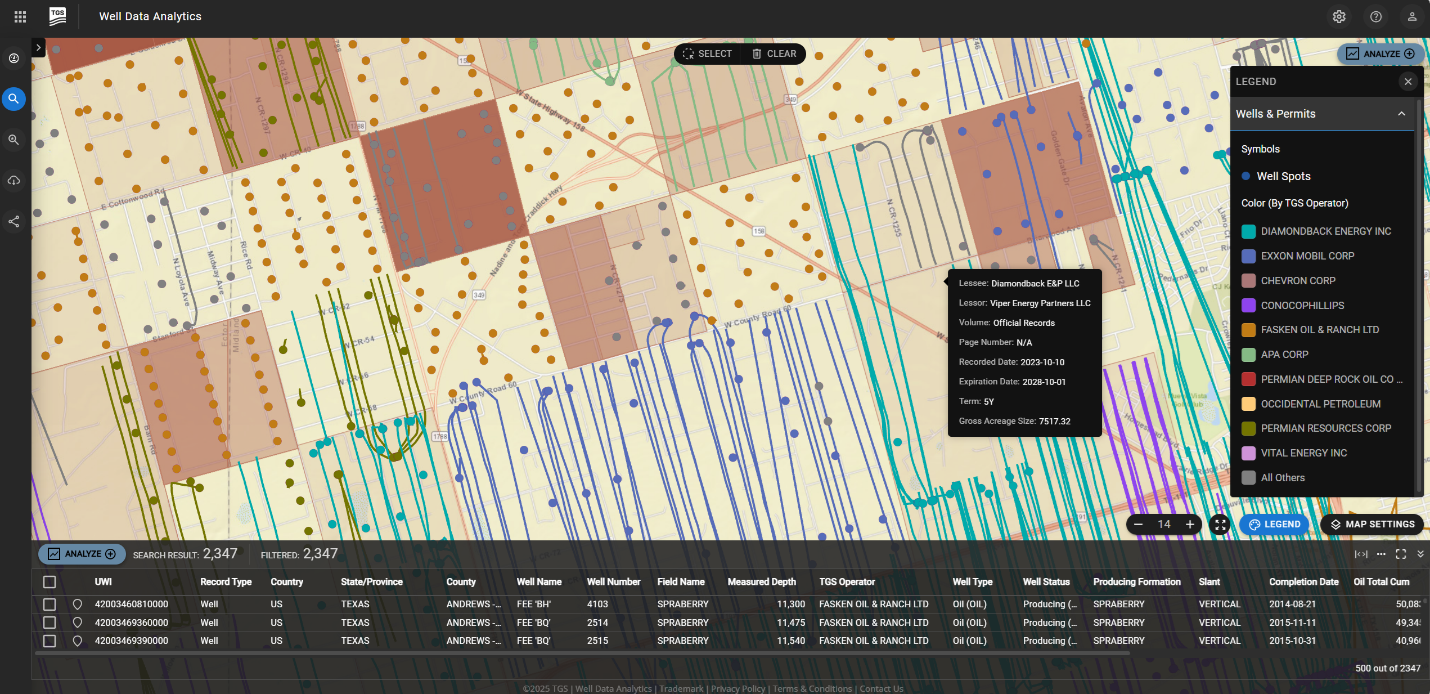

In the first phase of the integration, WDA users can now seamlessly access lease ownership data for Texas, New Mexico, and Oklahoma, as well as other subsurface well data. This combined offering enables E&P companies to plan wells more efficiently, reduce legal and operational risks, and optimize development strategies by aligning drilling programs with land ownership and leasehold constraints. Key use cases include merger and acquisition analysis, project site planning, investment evaluation, and resource inventory management.

Carl Neuhaus, Vice President of Well Data Products at TGS, said, "Our partnership with Oseberg creates a full-service subsurface data offering combining the highest quality lease data with the most comprehensive geological and well database. Integrating Oseberg lease ownership data empowers our users to verify land ownership in minutes and use TGS data to quantify resource deliverability, improve development planning accuracy, and quickly identify the most valuable opportunities. As always, these workflows are developed with customers to ensure seamless integration and hassle-free displacement of existing solutions.”

Evan Anderson, CEO/CO-Founder of Oseberg, added, "You need clean, structured, and context-rich information to make real decisions. For our lease ownership data, we’ve chosen to focus where others haven’t: structuring the unstructured filings that underpin everything from the right to drill to the creation of proration units at the tract and formation level. This layer of insight is the bedrock on which reserves, strategy, and execution rely.

That’s why, when we found a partner with complementary strengths in well and production data, TGS was the clear choice. In a world where public data can obscure critical details like elevations, depths, perforations, producing formations, and drill stem tests, TGS’ unparalleled subsurface and well log library unlocks a level of understanding that few others can match. Together, we’re harmonizing two bedrock layers of the upstream story, and we’re excited about what that enables for the market.”

The lease data provided by Oseberg in the TGS Well Data application overlaying the well data.

About TGS

TGS maintains the industry’s most extensive well data library, comprising over 100 years of curated public and non-public sources. Our user-friendly Well Data Analytics tool integrates high-quality well data with adaptable search workflows, map-based visualizations, advanced plotting and customizable dashboards within a cloud-based application. For further information, please visit www.tgs.com (https://www.tgs.com/).

About Oseberg

Oseberg is a next-generation data company transforming unusable oil & gas public filings into actionable intelligence. Our NLP engine dStill handles what generic AI can't - handwritten notes, inconsistent formatting, and domain-specific language. We create continuously updating streams of structured data that enable real-time signal detection, helping land, regulatory, and strategy teams anticipate what's coming, not just interpret what happened. From filings to foresight. Learn more at oseberg.io.

For media inquiries, contact:

Bård Stenberg

IR & Business Intelligence

investor@tgs.com

Analysen zu TGS-Nopec Geophysical Company ASAShs

Abgestürzte Blue Chip Aktien – Wall Street Live mit Tim Schäfer

Tim Schäfer live aus New York – dieses Mal mit einem spannenden Blick auf abgestürzte Blue-Chip-Aktien, bei denen sich ein Einstieg lohnen könnte. Gemeinsam mit David Kunz analysiert Tim prominente Verlierer der letzten Monate, die möglicherweise vor einer Erholung stehen.

Themen im Video:

🔹 Merck & Co. (USA) – Probleme mit Impfstoffen und Patentlaufzeiten

🔹 Pfizer – Wachstumsdruck durch auslaufende Patente

🔹 United Health – Ermittlungen und steigende Gesundheitskosten

🔹 Novo Nordisk – Abnehmspritze, Wettbewerb und Marktkorrektur

🔹 Nike – Konsumflaute und neue Konkurrenz

🔹 Estée Lauder – Kursabsturz, China-Schwäche und Hoffnung auf Turnaround

🔹 Campbell Soup – Value-Aktie mit attraktiver Dividende

🔹 Regeneron – Erfolgreiche Gründerstory mit Herausforderungen

👉🏽 https://bxplus.ch/wall-street-live-mit-tim-schaefer/

Inside Trading & Investment

Mini-Futures auf SMI

Inside Fonds

Meistgelesene Nachrichten

Top-Rankings

Börse aktuell - Live Ticker

SMI und DAX gehen tiefrot ins Wochenende -- Wall Street beendet Handel leichter -- Asiens Börsen letztlich im MinusDer heimische sowie der deutsche Aktienmarkt präsentierten sich zum Wochenschluss deutlich leichter. Die Wall Street bewegte sich am letzten Handelstag der Woche abwärts. An den asiatischen Börsen waren am Freitag ebenso Abschläge zu sehen.

finanzen.net News

| Datum | Titel |

|---|---|

|

{{ARTIKEL.NEWS.HEAD.DATUM | date : "HH:mm" }}

|

{{ARTIKEL.NEWS.BODY.TITEL}} |