|

24.03.2025 15:45:07

|

AMINA Bank: Bringing the World Onchain

In this edition of the Crypto Market Monitor, we look at the current state of onchain real world asset tokenisation market, the key developments in the space and what’s to come for this rapidly growing sector in the digital assets space.

The Current State of RWAs Onchain

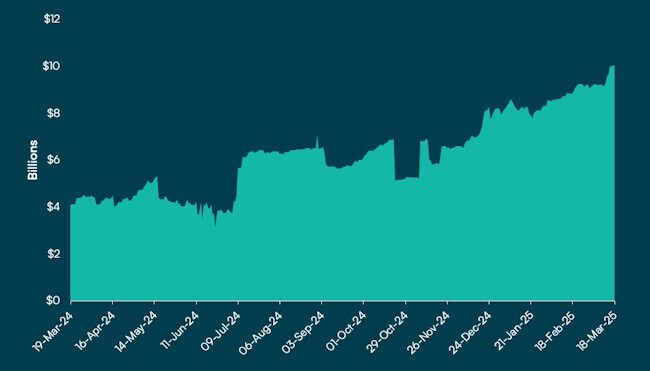

Currently, tokenised RWAs encompass a range of assets. Real estate, commodities and bonds are some examples of RWAs currently being tokenised on distributed ledgers. Why? This is because by converting these assets into blockchain-based tokens, liquidity, accessibility and transparency for such assets are greatly improved. RWAs are not a very recent phenomenon in crypto. Between 2020 and 2024, RWAs have grown 200% year-over-year. Total value locked (TVL) in the sector climbed steadily over the past half decade, crossing the $10 billion mark this year. This growth highlights increasing institutional interest and broader adoption of tokenized assets.

Figure 1: Growth in TVL for the RWA sector

Source: AMINA Bank, DefiLlama (18th March 2025)

Currently, the combined market capitalisation of cryptocurrencies that fall under the RWA sector is roughly $33.56 billion and over the past one week, it has seen a 29.7% increase making it one of the best performing sectors for the timeframe. Major categories in the RWA space include debt and private credit, real estate, commodities, carbon credits and collectibles. A particular sub-category of RWAs that is rapidly expanding is Gold-backed asset tokenisation. Let’s dive deeper into this RWA instrument.

Gold-backed RWAs: A Stable Pillar Gold-backed tokens offer investors a secure hedge against inflation while maintaining liquidity within the crypto ecosystem. As illustrated in the chart below, gold-backed token TVL indicates strong demand for onchain access to gold, with the metric doubling from sub-$2 billion in late December 2024 to over $4 billion currently.

Figure 2: The rise in Gold RWAs onchain

Source: AMINA Bank, DefiLlama (18th March 2025)

This recent surge in demand for access to gold is a result of the commodity’s exceptionally strong performance in 2025. So far this year gold prices have hit multiple new highs and this performance has been replicated across major currencies. This was driven by economic trends and sustained investment demand for the asset. Geopolitical and economic uncertainty and inflation concerns are fuelling investment demand and influencing prices.

The Bigger Picture for RWAs

The broader onchain RWA market reflects even more compelling growth trends. The sector’s TVL growth is consistently upward, marked by surges coinciding with the expansion of DeFi protocols integrating RWAs. This trend reflects growing investor confidence in tokenised real-world assets as an accessible, transparent, and profitable investment avenue.

Some major developments driving onchain RWA tokenization this week include:

1. Bahrain-based ATME launched its first gold-backed RWA token, allowing accredited investors to trade or redeem 1kg gold tokens seamlessly. The exchange plans to expand into other tokenised asset classes, integrating blockchain with traditional finance.

2. Blue Hat Interactive Entertainment Technology (BHAT) and Axis Capital Group partnered to launch the world’s first large-scale gold RWA tokenization project. This initiative will digitise real gold assets, enhancing liquidity, accessibility and transparency. BHAT brings deep industry expertise, while Axis Capital ensures regulatory compliance and market integration. The project aims to set a benchmark for digital gold investments and reshape the traditional gold market.

3. Aave Labs introduced Horizon, an institutional DeFi initiative that enables tokenised money market funds (MMFs) as collateral for stablecoin liquidity. By integrating RWAs into DeFi, Horizon enhances institutional participation while leveraging Aave’s GHO stablecoin as a decentralized liquidity source.

Key drivers behind this rise include:

- Institutional interest: Global financial giants are actively exploring onchain RWA tokenisation to streamline asset management and unlock liquidity in previously illiquid markets. Firms like BlackRock, Janus Henderson and State Street are increasingly integrating RWA tokenization into their financial models to improve asset liquidity and efficiency.

- Enhanced security and transparency: Blockchain's immutable ledger ensures that tokenised assets maintain clear ownership records, reducing fraud risks. Additionally, smart contracts automate transactions and enforce contract terms, improving security and reducing operational risks.

- Yield opportunities: RWAs offer stable returns that attract both conservative investors and yield-seekers looking for alternatives to volatile crypto markets. Tokenised government bonds, real estate and gold-backed assets have emerged as attractive options. DeFi protocols that integrate RWAs are also introducing new earning mechanisms, combining traditional asset stability with crypto-native yield opportunities.

Challenges and Future Outlook

Despite its rapid expansion, onchain RWA tokenisation faces hurdles. Regulatory uncertainty, custody concerns and interoperability issues remain critical challenges. However, the steady adoption of tokenised assets by major institutions signals a positive trajectory for the sector. Secondary market liquidity too remains a challenge for RWAs, slowing investor adoption. Interoperability across multiple blockchains is another factor crucial for market expansion.

Conclusion

The surge in onchain RWA TVL is more than a passing trend: it reflects a fundamental shift in how value is managed, transferred and stored. It is a no-brainer that players building for RWA adoption (Ondo and Maple Finance, for example) will benefit in the space. However, an overlooked eventuality is that even oracle networks like Pyth and Chainlink stand to benefit hugely from the data services that RWA tokenisation solutions require for maintaining integrity in asset valuations across the onchain and offchain worlds.

With gold-backed tokens providing stability and broader onchain RWA adoption accelerating, metrics for this sector are poised to only go up-and-right on the charts. The lines between tradfi and defi continue to blur, and RWAs will play a pivotal role in reshaping global finance for years to come.

Disclaimer - Research

This document has been prepared by AMINA Bank AG ("AMINA") in Switzerland. AMINA is a Swiss bank and securities dealer with its head office and legal domicile in Switzerland. It is authorized and regulated by the Swiss Financial Market Supervisory Authority (FINMA).

This document is published solely for educational purposes; it is not an advertisement nor is it a solicitation or an offer to buy or sell any financial investment or to participate in any particular investment strategy. This document is for distribution only under such circumstances as may be permitted by applicable law. It is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or would subject AMINA to any registration or licensing requirement within such jurisdiction.

No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained in this document, except with respect to information concerning AMINA. The information is not intended to be a complete statement or summary of the financial investments, markets or developments referred to in the document. AMINA does not undertake to update or keep current the information. Any statements contained in this document attributed to a third party represent AMINA's interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party.

Any prices stated in this document are for information purposes only and do not represent valuations for individual investments. There is no representation that any transaction can or could have been affected at those prices, and any price(s) do not necessarily reflect AMINA’s internal books and records or theoretical model-based valuations and may be based on certain assumptions. Different assumptions by AMINA or any other source may yield substantially different results.

Nothing in this document constitutes a representation that any investment strategy or investment is suitable or appropriate to an investor’s individual circumstances or otherwise constitutes a personal recommendation. Investments involve risks, and investors should exercise prudence and their own judgment in making their investment decisions. Financial investments described in the document may not be eligible for sale in all jurisdictions or to certain categories of investors. Certain services and products are subject to legal restrictions and cannot be offered on an unrestricted basis to certain investors. Recipients are therefore asked to consult the restrictions relating to investments, products or services for further information. Furthermore, recipients may consult their legal/tax advisors should they require any clarifications.

At any time, investment decisions (including whether to buy, sell or hold investments) made by AMINA and its employees may differ from or be contrary to the opinions expressed in AMINA research publications.

This document may not be reproduced, or copies circulated without prior authority of AMINA. Unless otherwise agreed in writing AMINA expressly prohibits the distribution and transfer of this document to third parties for any reason. AMINA accepts no liability whatsoever for any claims or lawsuits from any third parties arising from the use or distribution of this document.

Research will initiate, update and cease coverage solely at the discretion of AMINA. The information contained in this document is based on numerous assumptions. Different assumptions could result in materially different results. AMINA may use research input provided by analysts employed by its affiliate B&B Analytics Private Limited, Mumbai. The analyst(s) responsible for the preparation of this document may interact with trading desk personnel, sales personnel and other parties for the purpose of gathering, applying and interpreting market information. The compensation of the analyst who prepared this document is determined exclusively by AMINA.

Top Kryptowährungen

- 1T

- 1W

- 1M

- 3M

- 1J

- 3J

| Department Of Government Efficiency (dogegov.com) | 0.0306 | 41.54% | K | V |

| EOS | 0.7034 | 7.69% | K | V |

| Compound | 39.1080 | 5.62% | K | V |

| Aave | 194.3570 | 4.40% | K | V |

| HarryPotterObamaPacMan8Inu | 0.0059 | 3.95% | K | V |

| Dogecoin | 0.1880 | 2.95% | K | V |

| Maker | 1’536.9368 | 1.79% | K | V |

| Ethereum | 2’151.9398 | 1.40% | K | V |

| Ripple | 2.0100 | 1.39% | K | V |

| Polkadot | 4.0272 | 1.25% | K | V |

Inside Krypto

Ob Industrie 4.0, Luxusgüter oder Internet-Infrastruktur - hier finden Sie aktuelle Anlagetrends mit vielen Hintergrundinformationen und passenden Trendaktien. Jetzt mehr lesen

Krypto-ETPs erklärt: Risiken, Chancen & Markttrends | BX Swiss TV

📈 Krypto ETPs in der Schweiz: So funktionieren sie wirklich! | Experteninterview mit Rechtsanwalt Luca 🇨🇭💼

Krypto ETPs werden in der Schweiz immer beliebter – aber was steckt rechtlich eigentlich hinter diesen Produkten? Und wodurch unterscheiden sie sich von ETFs oder Kryptofonds? In diesem spannenden Experteninterview bei klärt David Kunz (COO der BX Swiss) mit Rechtsanwalt Luca Bianchi (Partner bei Kellerhals Carrard) alle wichtigen Fragen zur Regulierung, Strukturierung und Besicherung von Krypto-ETPs.

📊 Ein Muss für alle, die sich für digitale Vermögenswerte, strukturierte Produkte und Krypto-Investments interessieren – ob Privatanleger oder institutionelle Investoren!

👉🏽 Jetzt auch auf BXplus anmelden und von exklusiven Inhalten rund um Investment & Trading profitieren!